UK mid-market: proportion of SBOs hits 18-month high

Two thirds of UK lower-mid-market deals were sourced from other GPs in Q2, according to the unquote" proprietary database, marking the highest level recorded in more than 18 months. Greg Gille reports

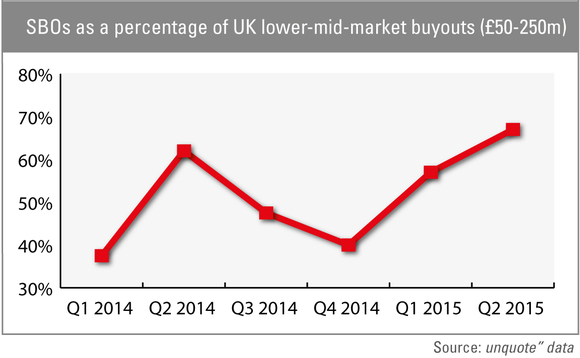

Sourcing for lower-mid-market deals (defined here as buyouts valued in the £50-250m range) seems to have become increasingly biased towards secondary buyouts, judging by the latest figures from unquote" data: 67% of such transactions were sourced from fellow GPs in the second quarter, against 57% in the first three months of the year. The latter figure was already a significant jump from the last quarter of 2014, when 40% of all buyouts were secondary transactions.

The second quarter of any given year is usually expected to feature a higher proportion of secondary transactions, as GPs on both the buy- and sell-side rush to complete deals inked in the first half before the summer lull sets in. Indeed, SBOs were also prominent in Q2 last year, accounting for around 62% of all transactions in the £50-250m segment. That said, the Q2 2015 figure marks a new high for such deals, being the highest percentage recorded since January 2014.

Notable UK assets that changed hands between private equity houses in Q2 included creative software provider The Foundry, sold by Carlyle to HgCapital for £200m in June. Elsewhere, ECI Partners acquired cycling retailer Evans Cycles from Active Private Equity in a transaction thought to be worth in the region of £100m, while Bridgepoint Development Capital sold Shimtech Industries to Auctus Industries and Inflexion Private Equity in a deal worth £141m.

It is also worth noting that the UK has been departing from the wider European trend. While the UK's proportion of lower-mid-cap SBOs was in fact lower than the European average in the first quarter (57% against 63% of all deals), the tendency to source assets from fellow GPs eased somewhat on the continent in Q2 (56% of all deals) while it intensified in the UK as pointed out above.

Corporate spinouts on the wane

Meanwhile, transactions sourced from family or private vendors remained relatively common in the UK in Q2, with a third of £50-250m buyouts being sourced from such vendors – although the quarterly average across 2014 was seen to hover around the 40-45% mark.

The real casualty of this rush to buy and sell among private equity houses were deals sourced from corporate vendors: spin-offs accounted for just 7% of lower-mid-cap dealflow in Q1 and no such transactions were recorded in Q2, whereas they accounted for nearly 17% of all deals in H1 last year. It remains to be seen whether the lack of corporate spin-offs is just temporary as GPs opt for the convenience of secondary transactions rather than pursuing more complex carve-out scenarios, or if it is the sign of a wider dearth of opportunities.

Meanwhile, preliminary figures from July could indicate that the rise of secondary buyouts in the UK lower-mid-market might be easing somewhat. Although dealflow as a whole was more subdued last month, buyouts were more evenly spread between SBOs such as the £250m Côte Restaurants deal and corporate spin-offs including the £240m Appleby Fiduciary & Administration deal by Bridgepoint.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater