Sponsored content

What does that mean?

UK fundraising continues apace in 2017

UK GPs continue to make hay in the strong fundraising climate, and 2017 is on track to produce another bumper crop. Gareth Morgan digs into the detail

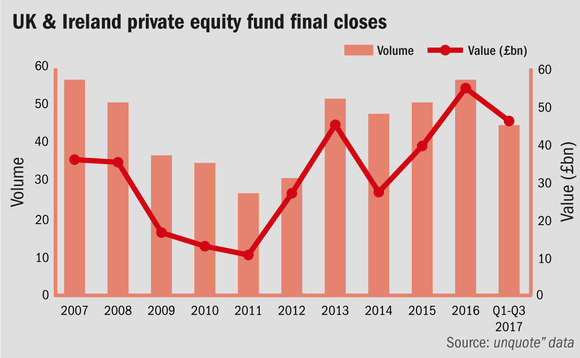

Private equity fundraising in the UK broke records in 2016, with just shy of £55bn closed by 57 funds. Similar to the strength seen elsewhere in Europe, 2016 marks the largest value of UK-managed funds holding final closes on record, beating the previous high-water mark of £45.1bn set in 2013. The number of funds also reached a post-crisis high in 2016, matching the 57 raised in 2007.

This buoyancy has continued into 2017; to the end of Q3 this year, unquote" data has tracked 45 funds holding final closes, securing a total of £46.14bn. "Now feels like the busiest period in terms of fundraising that I can remember," says Angela Willetts, managing director at Capital Dynamics, who has been evaluating private equity fund investments for 30 years.

With several large-cap funds in the market looking set to close in 2017, including BC European Capital X and TDR Capital IV, targeting €7.5bn and €2.5bn respectively, 2017 has every chance to top 2016, and continue the record-breaking fundraising environment in the UK. Currently, 2017 sees the average fund size above the £1bn mark, and should the year close above this benchmark, it would be the first time on record.

LP appetite

A large part of this fundraising boon comes down to LPs increasing allocations to alternatives. "There is very little alpha left in other asset classes," Sunaina Sinha, managing partner of Cebile Capital says. "LPs are therefore increasing their allocation to alternatives, and specifically to private equity as the largest alternatives asset class. For example, some allocations have gone from 6-8% to 11-12%."

Private equity portfolios have also been steadily returning cash to LPs, as the current pricing environment is particularly conducive for private equity firms looking to divest assets. "There is a very strong exit environment, not just from other sponsors, but also trade sales," says Darren Forshaw, senior partner at Endless. "Economic conditions mean trade buyers can stockpile cash on their balance sheet, and invest from that. There is also a lot of overseas capital flowing into the UK on sterling weakness." Cebile's Sinha agrees: "We've seen record realisations within existing portfolios, and so LPs are facing a cash overhang problem."

These factors are common across Europe, but LPs are particularly keen on funds targeting the UK, since the market has traditionally been the most active in Europe. Says Rede Partners' head of origination, Dushy Sivanithy: "The UK has had consistently higher deal volumes than elsewhere, and for LPs this is a reassurance that their money will be put to work."

With this growing attention on the UK comes greater competition, and LPs are increasingly facing challenges in accessing top-performing funds. "Allocation is becoming more difficult for everyone," says Willetts. "Capital Dynamics are a longstanding group with well-established relationships with underlying fund managers, so access isn't a problem, but we are seeing more and more funds that are oversubscribed." Anecdotally, market participants are reporting in conversations with unquote" that LPs are having to work hard to convince GPs to take their capital, a situation that is unprecedented.

The UK has had consistently higher deal volumes than elsewhere, and for LPs this is a reassurance that their money will be put to work" - Dushy Sivanithy, Rede Partners

GPs are taking advantage of the current environment to shift terms in their favour. "There has been a shift in power in dictating terms," Sinha says. "LPs are now term takers, rather than term makers. The balance of power is firmly with GPs, and terms are GP-friendly across the board." This has the potential to sour longstanding relationships between GPs and LPs; there have been cases reported where reducing the preferred return rate has caused LPs to reject the opportunity to back the latest funds of managers with whom they have well-established, successful associations.

There is a section of the market, however, where LPs are able to flex their muscles in negotiating terms. According to Sam Kay, partner at Travers Smith: "Top-tier GPs with oversubscribed funds are able to dictate terms. On the flip side, GPs struggling to raise are having to accept term demands from LPs, who are becoming increasingly aggressive in negotiating them down."

The availability of capital elsewhere in the market, however, means fundraising continues unabated.

Headwinds

In many ways, the continued strength is a little surprising; until recently Brexit negotiations have shown little sign of progress, leaving the medium-term future of the British economy subject to an increasingly high level of uncertainty, and pricing for assets has continued to ramp up amid high levels of competition. "We've not yet seen a material impact of Brexit – the elephant in the room – on LP appetite for UK funds," says Sivanithy. "North American LPs have gone in both directions, some are cutting exposure, while others are seeing the opportunity for a potential market dislocation and upping their allocation to the region."

According to one industry indsider: "Brexit is only used as an excuse not to back a UK fund if the LP is unsure of the team or the strategy, if they are confident in the team it's not an issue."