In Profile: ECI Partners

With ECI Partners celebrating its 40th anniversary this year, Denise Ko Genovese talks to managing partner David Ewing about the deployment of the GP's latest fund and the challenges facing the industry

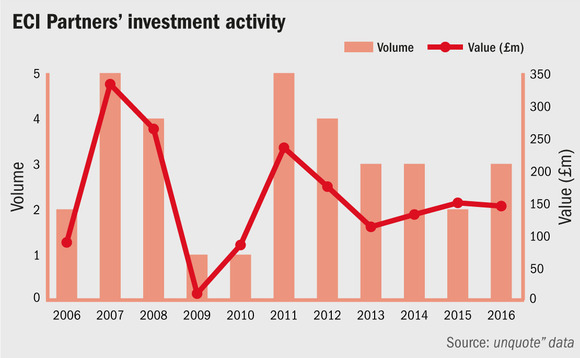

In the four decades since its formation, ECI Partners has raised 10 funds and completed 253 investments; the GP celebrated its 40th anniversary in June this year.

"All of ECI's recent funds have exceeded their targets," says David Ewing, managing partner at ECI. "The most recent, ECI 10 – raised in the summer of 2014 – achieved its hard-cap in four months at £500m with significant demand."

That fund is now 45% deployed, over five investments – IT Labs, MPM, Imagesound, Tusker and Evans. Its predecessor, ECI 9, held a first and final close in December 2008 on £437m against a £400m target and is fully invested in 15 companies, with six exits at a realised multiple of 4.5x. All six – CarTrawler, Fourth, Wireless Logic, XLN Business Services, Citation and Reed & Mackay – generated more than 3x individually. Fund 8 closed in April 2005 on £258m and Fund 7 closed in May 2000 on £177m.

Larger funds obviously mean larger fees but we are more interested in optimising the performance of our funds rather than moving out of our core market" – David Ewing, ECI Partners

The GP typically does one to two co-investments per fund, the most recent of which was in ECI 9 for Clarke Energy in August 2012. Though a growing theme for the industry in general, co-investments are possibly less prevalent for a GP like ECI given its sweet spot of £75m EV companies, typical ticket size of £40m, and its resolve to retain this focus.

"Larger funds obviously mean larger fees but we are more interested in optimising the performance of our funds rather than moving out of our core market," says Ewing. "The monitoring and directors' fees for our deals goes back into the fund 100% and always has done as we want alignment with the LPs."

While GPs are increasingly adopting unconventional fund structures, such as implementing a 0% hurdle or a consultancy fee for portfolio companies, ECI has historically stuck with a standard framework: 10-year funds with 2% fees and 20% carry, together with a hurdle.

From premium pet food to cycle mania

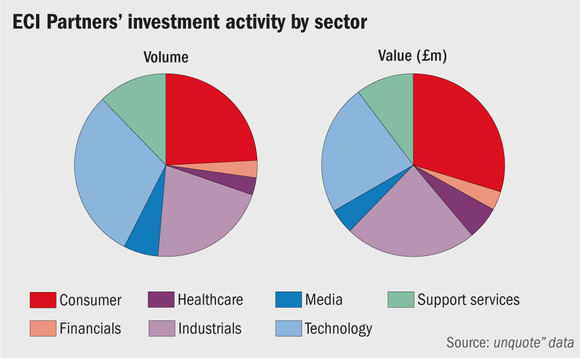

Most of the investments ECI does are in three core sectors: consumer, business services, and technology, media & telecommunications. Acquisitions in recent years include premium pet food producer MPM, which operates under the Encore and Applause brands; multi-channel cycle retailer Evans; and luxury catering brand Rhubarb. The average enterprise value is currently around £75m but ECI invests in an EV range of £20-150m.

When it comes to buying a company, ECI admits to doing many deals on an all-equity basis. "Where appropriate we will underwrite the debt in order to be seen as deliverable and to help with execution. Therefore we just take on the secondary approval risk temporarily, but we will already have sounded people out for debt in advance, often with a soft staple," says Ewing.

It also tries to pre-empt a process where possible. Both the acquisitions of Imagesound and Tusker were pre-emptive of the process and completed on an all-equity basis.

"Roughly 75% of ECI's investments are primary buyouts from founder entrepreneurs and we seek to pre-empt processes or have preferred access through our origination activities. If you have a business with a £75-100m enterprise value, you don't transact with the first person who knocks on the door."

As to the proliferation of direct lending funds, Ewing says ECI typically uses clearing banks but does admit to feeling that the supply of debt has been freer and on better terms over the last two-to-three years. "Clearing banks are a known quantity to ECI and we have established relationships going back 20 years plus. The pitfalls of private debt are yet to be tested," he says.

Telling the story

"The UK is full of great entrepreneurs creating lots of compelling investment opportunities but as an an industry we need to be telling the private equity story better, so that this pool becomes deeper and more companies transact with us," says Ewing. "Some people don't have a good handle on exactly what we actually do and the value we can bring both from within our network and from our operational capability."

The GP identifies roughly 2,500 companies as possible targets – within their size range and with the right growth characteristics – but only 75-80 work with private equity each year.

"We are at a point in the cycle where the number of transactions per annum is not moving up aggressively compared to the amount of capital coming back to market from LPs. So one of the biggest challenges the community faces at the moment is how to deploy capital," says Ewing, referring to how the wave of exits over the past few years has resulted in record net distributions to limited partners.

Depending on the climate, either the GP or the LP can be in the stronger position, he says. Although there is fierce competition with hundreds of GPs looking for LP investment, it is important to note there are many LPs looking to put money to work as well, he says.

• Steve Tudge, managing partner and member of the investment committee, is also chairperson of the partnership board. Tudge joined ECI in 1994, having spent eight years at Coopers & Lybrand (now PwC).

• Sean Whelan is managing partner and member of the investment committee. Whelan has overall responsibility for ECI's investor relations, exit strategy across the portfolio, and post-investment added value, including the commercial team. He joined ECI in 1998 after working as a strategy consultant for Gemini Consulting and Bain & Company.

• David Ewing, managing partner and member of the investment committee, has overall responsibility for ECI's network, marketing and origination activities. He joined the GP in 2001 following an early career in software development.

• Chris Watt, managing partner and member of the investment committee, joined ECI in 1999 from Arthur Andersen where he specialised in private equity transactions.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds