GP Profile: Triton Partners

Almost 20 years after founding Triton, managing partner Peder Prahl reflects on the firm's turnaround approach and considers future challenges

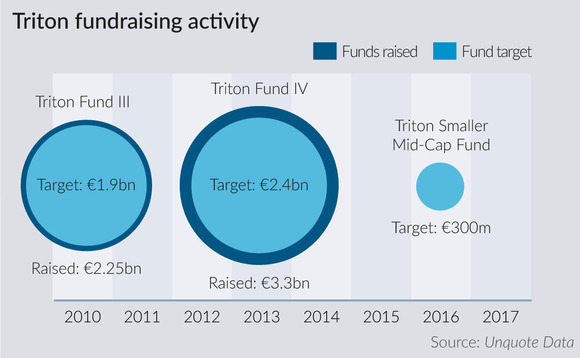

Triton Partners has gradually increased its fund size over the last 20 years but has not strayed far from its original strategy in terms of target sectors and deal size. The GP held a final close for its fourth fund on €3.3bn in May 2013 and the vehicle was 70% deployed by June 2017. In February 2018, it registered documents for Fund V, suggesting the firm is gearing up for another raise.

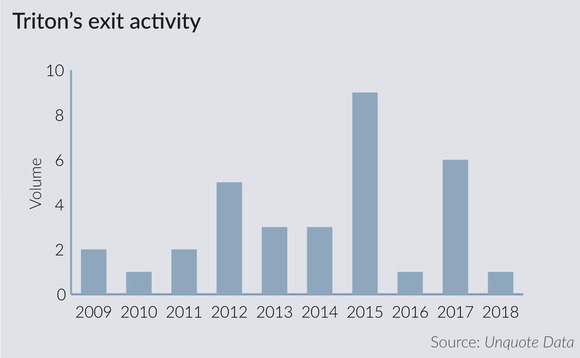

The fund manager has achieved a strong re-up rate in its latest vehicles. However, due to the turnaround nature of the investments, Triton funds are sometimes slower than their peers to realise their potential. "Returns are going up for the third fund," says managing partner Peder Prahl. "In the coming years we can expect them to be in the top quartile on an unleveraged basis. While we are in the process of fixing companies our returns can look quite flat, but they tend to go up a lot towards the end of the fund's life."

This is supported by figures from Unquote Data, which show Fund II was reporting a net IRR of 20.2% in December 2017, up from 18.6% in September 2016. Similarly, in the six months between June 2017 and December 2017, Fund III reported an improvement in net IRR from 8.66% to 13.5% and Fund IV improved from 3.92% to 13.5%.

Alongside fund returns, Prahl says LPs want direct exposure to the assets the funds invest in: "LPs are asking for co-investment to a much larger extent in the last five years than previously. We see it as our job to be good partners to our investors, and we provide quite a lot of co-investment, offering some form of co-investment on around 35-45% of our deals."

A selection of the largest LPs in Triton's latest fund include the Washington State Investment Board with a commitment of €200m, California Public Employees Retirement System with a commitment of $89.46m and California State Teachers Retirement System (CalSTRS) with a commitment of $59.07m.

Finding broken gems

Triton's approach has evolved from a different kind of investment thesis to other PE firms. Says Prahl: "We focus on sector-driven, intelligent origination. We like to buy companies that are facing some challenges that we can fix and then either sell or look to create growth." He says this marks Triton out from other buyout firms in Germany, particularly in its size bracket. "Most PE firms will buy good or great companies and try to ride their success and growth. But what we look for are companies we can improve and then help to grow."

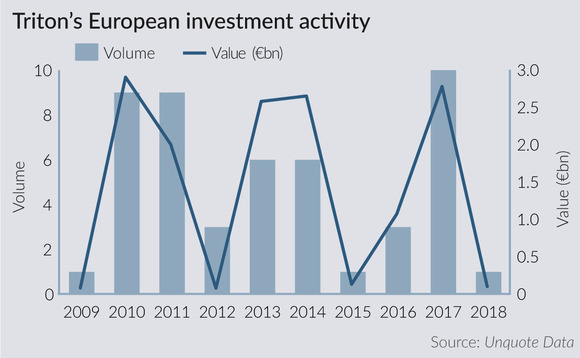

This outlook has yielded a wide range of opportunities for the firm to consider, but its core strategy has not changed much. Raising more capital has allowed it to pursue a few larger deals than would have previously been possible but it mostly sticks to the northern European mid-market. Prahl says: "As our investors have trusted us with increasing amounts of capital, we have started to make slightly larger investments. However, the size is not really the issue because we are buying companies that other firms do not want to buy."

Across its three divisions – industrials, business services and consumer/healthcare (by order of capital invested since inception) – Triton only employs partners with industry-specific expertise. The one exception to this is digitalisation. "We have sector experts that operate mainly in their fields of expertise, but we think that for digitalisation it is better to have a horizontal structure to transfer knowledge from one sector to another," says Prahl. "Therefore, we have had a digital team for some years now that is still expanding, and which operates across the three sectors."

Implementing sustainable futures

One of Triton's biggest success stories was the turnaround of autoparts supplier Stabilus. The company develops, manufactures and distributes gas springs and hydraulic dampeners for car door systems and had a lot of prestigious clients in the auto industry, including Volkswagen. Triton began purchasing debt in 2009 when the company was experiencing some difficulties.

"When we started investing in Stabilus in 2009, it was a company that had been successful, but when the financial crisis hit, they found themselves over-leveraged," says Prahl. "We worked with lenders to acquire the company and inject more money to create a sustainable balance sheet. Then we invested further capital to develop new products and new production facilities, particularly in China."

Stabilus had an enterprise value of around €300m when Triton injected €40m in equity into the company as part of a refinancing package in 2010. The firm listed Stablius on the Frankfurt stock exchange in May 2014 and made its final exit in March 2015, selling 4.2 million shares for €120m. The company's enterprise value had approximately doubled to €600m.

Although its operations are primarily focused on northern Europe, the GP has had some success looking further afield. Portfolio companies will almost always have some operations or expansion potential into Triton's core Nordic, DACH and northern Italy regions, though it has acquired companies owned or headquartered elsewhere.

One example of this was the acquisition of Spanish corporate Abengoa's Befesa division. Triton acquired Befesa in a transaction worth €1.075bn in June 2014. It made a partial divestment, selling the South American division to Ineos Enterprises in December 2015, and listed the remaining business on the Frankfurt stock exchange in November 2017 with a market cap of €954m. The GP's net proceeds from the listing were €415m, 1.6x the invested capital. "We acquired Befesa from Abengoa when a lot of Spanish building and construction utilities were under pressure in 2013. The company needed a lot of fixing, but the service it provides is a good one with a positive environmental impact, which is important to us," says Prahl. "We invested heavily in its growth and expansion into Germany and Asia, and listed it on the Frankfurt stock exchange."

Key people

• Peder Prahl, managing partner, founded the firm in 1997 after leaving Doughty Hanson. Prior to this, he had experience of working on PE investments for Morgan Stanley in the US.

• Martin Huth, investment advisory committee, joined the firm in 2003 from Warburg Pincus. Prior to this, he worked at Booz Allen Hamilton in Munich and had experience of PE from his time at Morgan Stanley in London and Frankfurt.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds