2022 Preview: Sponsors toast to incredible year, but remain wary of hangover

As bankers and fund executives across Europe begin to chill their champagne in celebration of yet another year of deal-making success, some may be wondering more than ever what it will take to cool down the red-hot M&A market. Min Ho, Harriet Matthews and Wahida Ahmed report

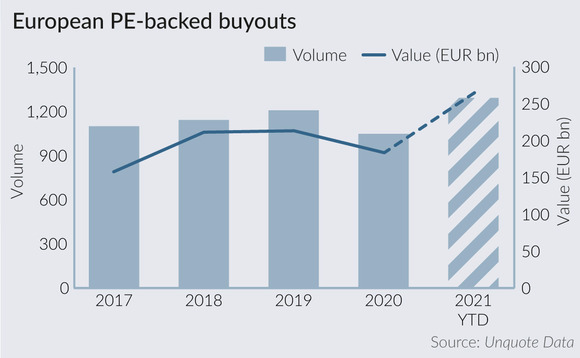

Buyout funds came into 2021 looking to make up for lost time after last year's pandemic lockdowns, with acquisitions by private equity firms jumping by nearly 80% so far this year to a record EUR 249.4bn, Dealogic data shows. Sponsors have also been taking advantage of the strong market, with the value of exit transactions increasing by 35% to EUR 148.2bn.

"We are seeing incredible times on the back of multiples, sizes, deal numbers and many other different fronts," says IK Partners' CEO Chris Masek. "It's been another consecutive year of new record settings – it's almost becoming boringly routine."

But with an impending rollback from the last decade-plus of amenable monetary policy globally, on top of the emerging Omicron Covid-19 variant and geopolitical risks, the question is: are movers and shakers beginning to sober up and at least dial down the party music?

Providence Equity is among some who are battening down the hatches as they seek ways to mitigate any surprises. While its peers could be seen deploying 40-70% of their capital in one single year, Providence has remained steadfast in working only 20% of its fund per year.

"We are swimming against that tide," says Andrew Tisdale, senior managing director at Providence. "I hear a lot of comments around 'this time is different, these are much better businesses than in 2000 or 2006-2007'. That may well be, but we think that one of the few ways you have to mitigate against macro swings over the lifecycle of a fund is to be disciplined in terms of pacing."

Maintaining discipline, bolt-on roll-ups and extreme selectiveness are oft-repeated narratives touted by sponsors and bankers when speaking about their investments, but there are concerns about whether they are enough to mitigate eye-watering valuations.

"While many are genuinely doing a lot of the right things in creating value for their assets, a lot of fund managers need to sober up and acknowledge that whether we like it or not, present peak performance is in large part driven by valuation inflation," says Masek.

A toast to tech

Technology (including computers, electronics and telecommunications) has unsurprisingly been the hottest sector, accounting for around 30% of deal value this year, Dealogic data shows. But the sector is garnering the most worried looks when it comes to valuations.

Calypso's USD 3.75bn sale by Bridgepoint and Summit Partners to US sponsor Thoma Bravo is among a handful of large 2021 buyouts. The asset, which was marketed based on around USD 100m in EBITDA, sparked a wave of other financial software peers to go on the market, including Vista Equity Partners-backed Finastra's financial division, FIS's capital market unit and Pirum Systems.

Investors are also tapping tech solutions that can help companies alleviate global supply chain issues, as highlighted by a handful of completed and upcoming deals, including Blujay and Koerber's intralogistics software business.

But advisers themselves are now curious to see how some sponsors are comfortable paying revenue multiples in excess of 10x, or 25-30x EBITDA multiples, for tech-related businesses and still be confident of seeing a return.

Oliver Parker, technology partner at Alantra, says that, while he does not foresee a big correction happening soon, investors should be mindful of how they will be able to make their returns should an event happen, and what impact a handful of high-profile failures can have on the broader market.

"You've got to wonder if, at some point, as people are paying ever-increasing revenue multiples, all it takes is for a couple of things to not go as well as expected during the PE cycle," he said.

Sponsors should now figure out whether there is a risk to their assumptions. Nasdaq, whose many constituent companies are used by European tech groups to benchmark their valuations, recently touched all-time highs. This is juxtaposed against central banks globally that are trying to regain credibility in taming decade-high inflation numbers.

Many others, however, are adamant that technology businesses will remain a safe bet, at least from any long-term volatility, thanks to their recurring, sticky revenues. Technology, which has long been part of the daily modern personal and commercial lives, has been further bolstered by the pandemic thanks to trends such as work-from-home.

"This pandemic is probably the biggest global event that we've seen in a generation or two that's affected the world," one banker notes. "If a company has come through the pandemic well in showing growth, it just shows you how robust that company is. The value has risen as a result of more demand from investors deploying capital in such companies."

Sectors on ice

While the party is far from over when it comes to technology-based companies, celebrations may just be kicking off for some in the leisure sector, thanks to recent notable deals such as the EUR 700m acquisition of European Camping Group by PAI Partners, tapping into the staycation trend amid the cross-border travel limitations.

In other consumer-related deals, the GBP 10.2bn take-private of supermarket chain WM Morrisons by Clayton Dubilier & Rice following a hotly contested auction was among the largest buyouts of the year within the consumer sector.

However, the increasingly prevalent and highly infections Omicron variant has set warning lights flashing again for businesses in the restaurants and bars space, as well as any business involved with live entertainment.

Ali Aneizi, founder of advisory boutique Tamweel Capital, notes that the potential effects on winter and Christmas trading are on the minds of many leisure sector companies.

"It's made people think twice about pulling the trigger, whether now is the right time to be exploring options," he says. "Maybe we need to wait for the dust to settle for us to get through winter and come out the other side of the uncertainty, then revisit plans later next year."

Still, certain deals got done in the sector, albeit with a side of caution. "For the hot assets and the standout brands, valuations have held up, but a lot of these deals have significant downside protection for the investor in the way they have been structured," Aneizi says.

Against this backdrop, a long-anticipated wave of distressed M&A is building, according to Aurelius Equity Opportunities partner Tristan Nagler. And it is not coming from the usual suspects.

"You will always see businesses in deep distress from unforeseen circumstances," Nagler says. "Instead, we are seeing it in sectors that are not classic casualties. This is partly indicative of what lenders are doing. Demand has come back, and even businesses with too much debt still need more money to accommodate resurging demand, such as to buy stock and increase workforce levels. During the crisis, many businesses de-stocked to collect cash, postponed creditor payments, and stood still to minimise the pain. But this needs to go in reverse once demand is back."

He cites energy companies as an initial casualty and also highlights businesses involved with automotive supply chains, aerospace and food producers, who might struggle with price inflation in the sector.

Corking year, or champagne problems?

Festivities are set to continue well into next year, even if some are willing to play the party pooper a la Scott Kleinman, Apollo Global's co-president, who warned that the industry is in a "state of collective delusion".

Well-acknowledged levels of dry powder in sponsors' coffers are likely to keep the momentum going into 2022, with the pressure to deploy capital still on. Many sponsors are anticipating that 2022 could be just as busy as 2021, in spite of mounting headwinds.

Much like the opposing fates of lockdown-bolstered versus pandemic-damaged sectors, the fundraising market has seen a bifurcation from which established managers with strong, outperforming returns have benefited.

Top-down LP preferences are likely to continue to drive both fundraising and deal-doing, notably when it comes to ESG due diligence concerns. Unilever's auction of its tea business piqued the interest of sponsors including Advent International, Cinven, Carlyle and ultimate winning bidder CVC, but social concerns around labour in its tea plantations were flagged by bidders.

Debevoise & Plimpton partners Geoffrey Kittredge and John Rife highlight the correspondingly increasing importance of impact investing: "Impact investing can be done in most markets. Sponsors have become increasingly focused on how they can combine ESG with making profits in developed markets."

Private equity has proven its resilience and appeal to institutional investors over the course of the Covid-19 pandemic. Sponsors have pointed to this fact as grounds for optimism for the year ahead, in spite of macroeconomic uncertainty. But with many firms having barely paused for breath in recent months, a return to the market with fresh eyes in 2022 may herald a review of priorities as they take stock.

With analytics by Mate Taczman

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds