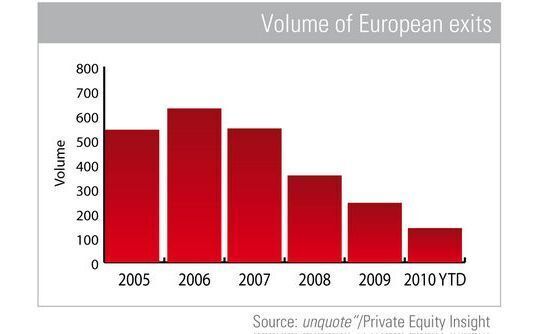

Exits: Volumes fail to make major recovery

Recent months have seen what seems like a flurry of exit activity, with secondary buyouts and IPOs dominating the headlines. However, exit volumes have barely reached levels seen this time last year. John Bakie investigates.

There have been a number of high-profile exits since the beginning of the year, including AAC's 3.8x return on the sale of TGI Fridays, or the secondary buyout of Ontex from Candover. While many have taken note of these exits, data indicates there has not been a significant recovery in exit volumes.

According to unquote" data, there have been 140 exits completed so far in 2010, however, this is just under half that seen in 2009. Furthermore, this is less than a quarter of the number exits seen when the market peaked in 2006.

This contrasts with acquisition and investment activity, where the number of deals, particularly buyouts, has been on the increase this year, and is widely expected to show a marked improvement on 2009, when the global recession was at its worst.

However, the pace of exits has picked up slightly in the past few months, with 59 exits in the second quarter of 2010, compared to 56 in the same period of 2009. This is may not be a significant improvement, but with a number of trade sales and secondary buyouts being mooted, as well as several companies awaiting stockmarket listings, there may be an upturn in figures later this year, which might bring further relief to fund managers and their investors.

It is also worth considering that many exits seen in early 2009 were write-offs or businesses that went into receivership. By contrast, many of those in 2010 have been more positive exits through trade sales, secondary buyouts and IPOs.

From a media perspective, private equity investors do seem to be making more noise when it comes to their exits. They may be keen to demonstrate that they can successfully sell companies, to attract future LP interest and distribute to existing investors. However, according to one senior LP: "The bigger risk is that the selling GP failed to maximise value just to demonstrate exits."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds