Venture follows money on cleantech

Global investment into the cleantech sector reached a record high last year of nearly $250bn, but venture is losing market share as it shies away from early-stage funding.

The number of venture investments into the sector has grown by a factor of six since 2000, but venture's market share by value was only around 1% last year, according to research from Sustainable Asset Management (SAM), an investment boutique owned by Robeco.

Venture backers are hesitant, the report suggests, to invest in early-stage funding rounds to target companies, preferring instead to focus on lower-risk sectors with smaller capital requirements, and/or focus on follow-on rounds for existing companies.

This second factor is reflected in the growth of later-stage expansion investment into cleantech, which was nearly $11bn last year.

Says Andrew Musters of SAM: "European VCs are focusing more on later stage because it takes a relatively long time for early stage clean tech companies to mature. It typically takes at least three to five years before for example a great invention of a university professor is mature enough to be developed up to a point that it becomes attractive for a utility company to be adopted. I expect this trend to continue although the strong drivers behind clean tech such as resource scarcity will shorten the adoption rate somewhat in the future."

It is also likely a result of the maturation of dedicated funds: the first dedicated cleantech private equity funds were launched in the 1990s and may now be on third- or fourth-generation vehicles, meaning their focus will be on growth-, rather than venture-, stage companies. More than $44bn has been raised by nearly 300 funds globally for the asset. In Europe, Unigestion Ethos Sustainability LLP is raising €100-150m, with nearly €70m currently accounted for.

Unsurprisingly, the US attracted the lion's share of cleantech funding, with two thirds of the investment since 2000 pumped into North American targets.

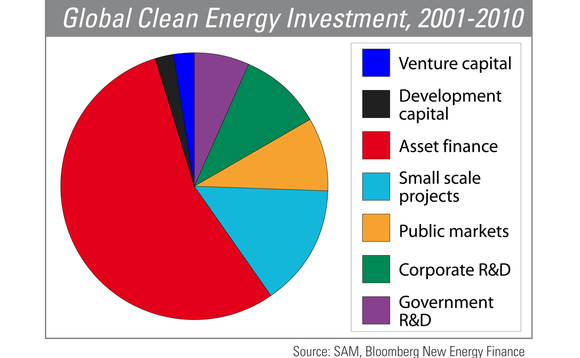

Venture and expansion funding remain a very small portion of the overall investment into cleantech, with asset finance accounting for the majority of investment dollars most years, accounting for $568bn of the $1,034bn funded between 2001 and 2010 (see graph). Small scale projects accounted for nearly 15% of the total, with corporate R&D a distant third at 10%.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater