Secondary buyouts take up record slice of exit market

A rich private equity war chest with more commitments directed at quick-dealing GPs is boosting the number of secondary buyouts despite exit volumes returning to more normal levels. Chris Papadopoullos reports

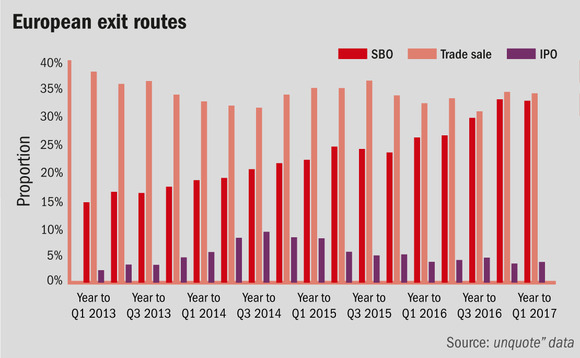

Exit numbers were relatively high between 2013-2015, as private equity houses offloaded assets they had delayed selling in the low-valuation post-crisis years. They have since cooled – there were 752 exits in the 12 months to the end of Q1, the weakest 12 months since 2003, according to unquote” data.

The proportion of those deals that were exited via a secondary buyout was 32.7%, which is bettered only by the 33% registered in Q4 2016. This rising proportion has come largely at the expense of IPOs. There were only 28 European exits via IPOs in the year to Q1 2017, representing 3.7% of exits. This is down from a peak of 90 in the year to Q3 2014 when 9.1% of exits were listings.

Sales to trade buyers remain a good slice of the exit market, contributing 34% of exits in the year to Q1 2017.

There are a number of factors behind the rising proportion of secondary buyouts. One has been the record amount of funding raised by private equity houses in 2016. But another is the fact this funding has been directed at GPs with younger portfolios.

Young blood

According to EY research, GPs with an average portfolio age below four and a half years (around 40% of GPs) are outperforming older rivals, leading them to attract more capital. Because they have a tendency to churn out more deals, this is increasing demand for unlisted companies.

"Entry rate and exit rate for young GPs is much faster," says John van Rossen, head of private equity at EY. "They make the hamster wheel spin much faster in their business. They drive higher returns and are now discernibly more successful in attracting capital."

"Looking forward, IPOs are coming down and waves of fundraisings are making the war chest of private equity quite rich, so there's a lot of pressure to put capital out there. The lending environment is also still relatively strong.”

Van Rossen expects trade buyers to continue to be strong players in the exit market despite greater competition from the private equity industry, given their strong balance sheets and healthy lending conditions. And while high market sentiment more generally has been tapered by uncertainty created by political events, private equity houses are still highly active.

"In 2017, the industry is continuing. Our pipeline is very strong, we're seeing a whole batch of deals being set up for the post-Easter period," van Rossen says.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater