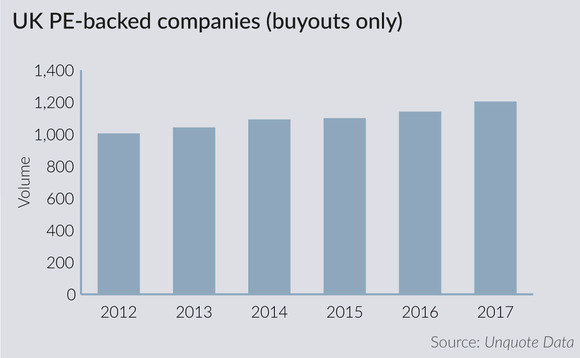

Stocking up: the rising number of UK buyout-backed companies

There were 1,204 companies in the UK backed by a buyout house at the end of 2017, according to Unquote analysis. The figure has steadily increased since 2012 when there were 1,005, which is no surprise given the rising momentum of the buyout market and supportive levels of fundraising.

Further swelling the number of companies that have undergone a private equity buyout has been a slowdown in the flow of exits. Exit numbers were high over the three years to 2015 as GPs took advantage of recovering asset prices to offload pre-crisis investments, but exits have since settled to a new normal of around 200 per year. These changes in flows have led to a 20% climb in the stock of buyout-backed UK firms over the past five years.

This population expansion is apparent in every market sector and segment, though some stood out more than others.

Financials rose by 30% and technology by 21%, while consumer and industrials are the largest sectors overall.

By enterprise value, it was the core mid-market (€50-250m EV at entry) population that expanded the most, growing 28%. The small-cap population (<€25m) barely grew, but this may partly be due to asset price inflation, which would have pushed some deals at the higher end of the bracket into the lower end of the next €25-50m bracket.

Investment is not too London-centric either. Of the current 1,204 businesses having undergone a buyout, 27% are based in the capital. This compares with 17% in the south-east, 12% in the north-west & Merseyside, and 7% in each of the West Midlands, Yorkshire & The Humber, East Midlands and the east. Scotland and the south-west account for 6% each.

There are around 113,000 private sector businesses in the UK with more than 20 employees, according to estimates from the Office for National Statistics. Given the vast majority of buyout targets will be in this category, this means just over 1% of all UK firms with 20 employees or more are currently backed following a private equity buyout.

Of course, some of these companies will be sliced and diced into other firms, complicating the matter somewhat, but the overall trends still reveal the growing importance of private equity as a source of finance for the growth of UK companies.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater