European fund launches off to slow start in 2021

The number of private equity funds launched by European managers in Q1 this year is significantly down on the volume recorded for the same period in 2020, as well as more recent quarters, Unquote Data shows.

While many expected 2020 to be a whitewash for fundraising efforts in light of the unprecedented impact of the pandemic, the market instead saw a very respectable number of final closes (165) compared with previous years. Furthermore, the continued ability of top-flight large-cap GPs to attract vast amounts of capital resulted in aggregate commitments of €140bn, eclipsing the totals seen in previous years, according to Unquote Data.

A fair proportion of these processes would have been initiated prior to the outbreak, though, and the impact on new fund launches was certainly much more marked throughout the past year.

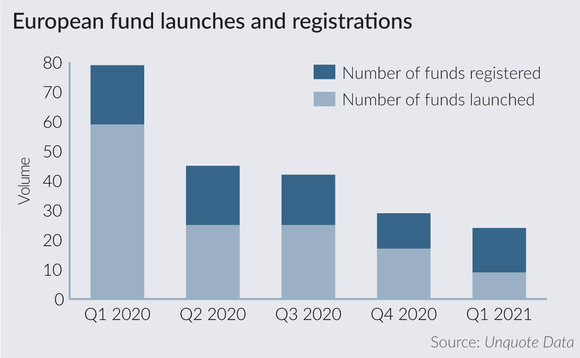

It would seem this is set to continue into 2021, especially after so many GPs successfully raised a new vintage in the past three years. So far, Unquote has recorded just nine official launches in Q1 2021, with a further 15 vehicles at the pre-marketing and/or registration stages. This compares with a whopping 59 fund launches in Q1 2020, a quarter that also saw at least 20 other vehicles filing registration documents.

Highlights of fund launches in Q1 this year have included Apax Digital Fund II, which came to market with a target of $1.5bn and is expected to close in Q2; and Afinum 9, which is targeting €450-500m and expects to hold a first close by mid-year.

While the pre/post pandemic context could explain such a drastic difference between the two first quarters, it is also notable that Unquote recorded a significantly higher number of launches in both Q3 and Q4 last year.

That said, the European fundraising pipeline remains crowded, with no fewer than 215 vehicles launched since 2019 and still on the road (to which we can add a further 96 vehicles thought to still be at the pre-marketing stage).

In addition, a number of processes were delayed by the pandemic, with some GPs opting to wait it out for a few months before coming back to market with their next vehicle. It is therefore likely that the tempo of new launches and pre-marketing efforts will ramp up as the year progresses, as highlighted in our most recent Fundraising Pipeline round-ups.

Investcorp plans to launch its second European buyout fund after the summer, aiming for €1-1.5bn, as reported. Meanwhile, Permira has also registered its second growth opportunities fund, Permira Growth Opportunities II, with a source close to the situation telling Unquote that the fund has a target of $2.5bn.

Over in Italy, small- and mid-cap private equity investor Arcadia plans to start marketing the launch of a new private equity fund by the end of the year, with a target of around €100m, as reported. Fondo Italiano d'Investimento is also preparing the imminent launch of a €700m fund dedicated to the Italian agri-food industry.

Click here to search the complete database of funds currently on the road on Unquote Data

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds