No sign of summer holiday for PE as dealflow beats records

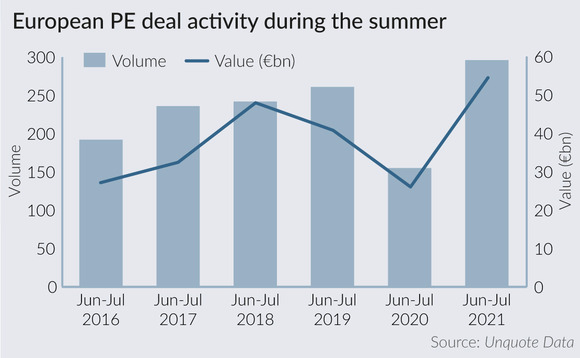

Buyout dealflow in the summer months of 2021 has reached a five-year high, showing that an easing of lockdown restrictions in many countries has not meant an easing of dealflow for European PE.

European buyout activity has already surpassed that of any summer in the past five years. Across June and July 2021, sponsors completed 296 buyouts in Europe, a 90% increase on the same period in 2020 and a 13% increase versus the last pre-Covid summer, in 2019.

Aggregate deal value in summer 2021 has also exceeded any period in the past five years, according to Unquote Data. The EUR 54.5bn's worth of deals completed is more than double the same period in 2020 and marks a 33% increase on 2019.

Activity barely dropped off between June and July 2021; June saw 153 buyouts totalling EUR 28.2bn, while July saw 143 deals amounting to more than EUR 26.2bn. While not unexpected after a relatively quiet Covid-heavy summer in 2020, the increase in announced deals in summer 2021 versus last year demonstrates the appetite for deals as the market recovers.

By volume, France was the most active region for deals, with 20% of activity taking place there. However, the UK & Ireland and the DACH region were not far behind, with around 18% of deals by volume each.

The two-month period saw eight deals valued at more than EUR 1bn, representing 37% of aggregate value, versus four such deals in the same period in 2020, representing 34% of aggregate deal value.

Three of these large-cap deals took place in the UK, including Brookfield Business Partners' USD 5bn acquisition of modular workspace rental specialist Modulaire Group from TDR Capital. While the UK produced almost a quarter of deals by aggregate value, the DACH region produced just 10%, indicating that the high dealflow in the region was bolstered by the resilient small-cap and lower-mid-market segments.

Taking into account figures from Unquote Data to date in August, and with the month not yet over, summer 2021 as a whole looks set to surpass value and volume records seen in previous summers, too. To date, aggregate deal value from June to August 2021 has surpassed that of the same period in 2019 by 8%, in part thanks to BC Partners and CPPIB's EUR 3.8bn CeramTec deal, as well as Hellman & Friedman's EUR 3bn take-private deal for pet supplier Zooplus.

Whether the remaining months of the year will be similarly busy remains to be seen, considering the uncertainty concerning how the coronavirus situation will develop in the autumn and winter. However, H1 2021 as a whole was a record half-year for European private equity, as reported by Unquote, and sponsors' eagerness for deals shows no sign of slowing to date.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds