PE activity reaches EUR 392bn in record-breaking 2021

The last quarter may have shown signs of a market slowdown, but 2021 nevertheless stands out as a phenomenal year for private equity deployment across Europe, writes Greg Gille

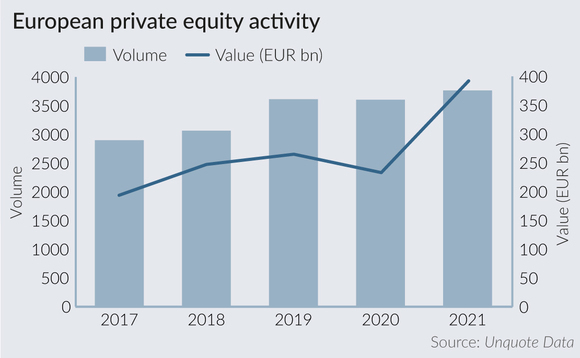

Close, but not quite: while activity in the first half of the year once hinted at the EUR 400bn mark being reached by year-end, early Unquote Data figures indicate that private equity deployment in Europe ultimately came just shy of that milestone.

Nevertheless, with the 2021 tally currently standing at 3,765 investments worth a combined EUR 392.3bn, last year was nothing short of phenomenal on the M&A front. While 2020 understandably saw a slight setback in the unabashed growth of the European PE market – despite activity roaring back towards the end of that year – 2021 saw one of the largest year-on-year aggregate value increases ever recorded in our proprietary database, with the aforementioned EUR 392bn total marking a 68% jump on the 2020 figure. And while deal volume saw a much more modest increase of 4.5%, it still set a new all-time record.

To put the scale of that 2021 deployment pace in perspective, overall deal value has more than quadrupled over the past decade, while dealflow has increased by more than 50% in the same timeframe, Unquote Data indicates.

Last year was rather heavily front-loaded in terms of deal volume, though. Q3 still saw growth in both the number and combined value of deal announcements, but the volume drop-off in Q4 is noticeable – the 701 deals provisionally recorded in that quarter are certainly a far cry from the 1,048 deals posted in Q1 last year.

That said, a glut of mega-deals inked towards the end of the year, combined with ever-increasing valuations across the board, meant that aggregate value was not affected; to the contrary, H2 saw a slight uptick to EUR 199bn, compared to EUR 193 in H1.

Looking ahead to 2022, many sponsors are anticipating that this year could be just as busy as 2021, despite potential monetary policy headwinds on top of the rapidly spreading Omicron Covid-19 variant and geopolitical risks, as reported. On the supply side, last year certainly remained a strong year for private equity fundraising: Unquote recorded 226 final closes of vehicles with a remit to invest in Europe, with aggregate commitments of around EUR 246bn, meaning that sponsors are unlikely to be deterred by ever-rising asset prices in their quest to deploy record levels of dry powder.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds