Turning to powder: European take-privates take pause

European M&A professionals have talked of тdry powderт so much for the last eight years that military metaphors have become clichУЉ.

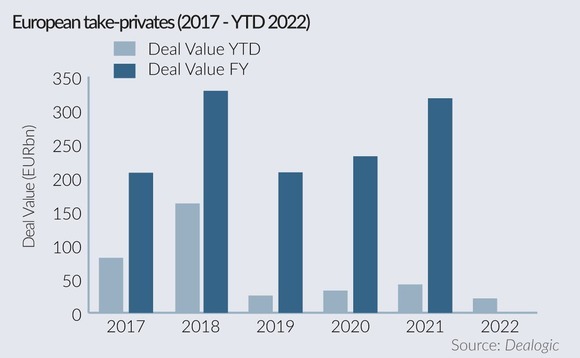

PE firms have had enormous capacity to finance deals since the ECB first set negative interest rates in June 2014. In these conditions, European take-privates hit EUR 200bn in each of the last six years, Dealogic data shows. They boomed in 2021, hitting EUR 317.9bn, up more than 37% on year. Three of the 10 biggest European take-private deals since the start of 2021 have included a PE bidder.

But gunpowder is more than a financial metaphor, as the world is learning again. Russia's invasion of Ukraine and rising interest rates have hurt market sentiment, including in the European take-private market, which is off to a slow start with just EUR 27bn of announced deal value this year.

Though the mood is now less ebullient, lower prices on stock markets have encouraged a few deals.

Europe's largest deal last year, KKR's EUR 36bn tilt at Telecom Italia, is an example of a fund seeing advantages in delisting a firm that trades poorly on public markets. Similarly, Pearson, a provider of educational materials, last week rejected a second unsolicited and preliminary proposal from Apollo Global Management.

A stint out of the stock-market spotlight can build an attractive equity story for a once-unfashionable brand, as Spanish storage company Mecalux has shown. Its potential return to the stock market after 12 years is targeting a value up to four times higher than it realised in 2010.

Spain – 137 reasons why

Spain could be a hotspot for take-private deals this year, according to local dealmakers. The declaration in 2020 of COVID-19 as a global pandemic triggered exceptional circumstances under Article 137 of the country's takeover code, making M&A harder to execute for two years.

This changed last weekend. Immediately after the exceptional circumstances expired, MFE (formerly Mediaset) made a play for its Spanish subsidiary, Mediaset España.

Dealmakers are optimistic that this will be the first of a wave of takeovers, including take-private deals. KKR's bid for Telecom Italia sets new target multiples for telecoms operators, making Telefonica a likely target, as reported. Meanwhile, LetterOne (L1) has a strong case to take Dia private so that it can complete its restructuring of the grocer without pressure from other shareholders, just as Mecalux's owners did, this news service has reported.

With fewer take-privates elsewhere in Europe, Spain could keep the lights on.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds