Articles by Greg Gille

M Capital Partners injects €1.5m into Savimex

French company uses polymers to produce optical products, including helmet visors and heads-up displays

Bain's Autodis announces intention to float

Autodis may implement a capital increase in the range of €350-400m as part of the IPO

France's Pragma Capital rebrands, eyes new fund launch

Pragma, which underwent a succession plan in 2016, will now be known as Sparring Capital

iBionext et al. in $15m round for GrAI Matter Labs

iBionext Growth Fund, 3T Finance and 360 Capital Partners back the French AI technology startup

PE-backed Varo shelves IPO

Fuel supply company, backed by Carlyle, announced its intention to float in March

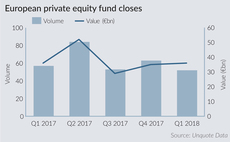

European fundraises off to healthy start in 2018

Number of fund closes and aggregate capital raised in Q1 is roughly on par with the same period last year, but short of the strong start to 2016

GCP promotes Shaw to partner

Shaw joined GCP in April 2012 and was previously an investment director at the firm

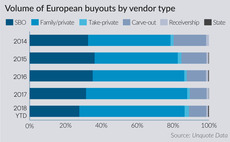

Secondary buyouts hit 10-year low in Q1

Proportion of deals sourced from fellow PE firms has ebbed back to the level last seen in 2007, according to Unquote Data

European entry multiples hit new high in 2017 despite Q4 cooldown

Average EBITDA multiple increased to 10.4x in 2017 compared with 10.2x in 2016, according to the latest Clearwater Multiples Heatmap

Capzanine promotes two in investment team

Clément Colin becomes principal and Emmanuel Fournial is promoted to senior associate

EIF’s push into private capital management

The European Investment Fund is aiming to raise up to €2.1bn in private capital for a new investment platform focused on venture and growth vehicles

Annual Buyout Review: Lower-mid-market momentum lifts dealflow

Unquote's lastest Annual Buyout Review is now available to download for subscribers, offering in-depth statistical analysis of 2017 activity

John Holloway moves onto new role at EIF

Holloway will look after a new initiative involving fundraising from the private sector

Triago bolsters New York office with Rogers hire

Kevin Rogers joins the private equity advisory firm in the US as a principal

Large-cap deals drive strong start to 2018 for European PE

GPs deploy an extra €7bn in aggregate value across European buyouts in the first two months of the year compared to 2017

Agic, Capvis, Gilde, Nordic Capital in final Amann Girrbach round

Nordic Capital is reportedly the front-runner in the sale of the Austrian dental prosthetics company

European PE in 2017: Scaling new heights

Buyout activity and fundraising reached a new peak in 2017, with mega-buyouts and small-cap deals fueling dealflow and French funds popular among LPs

Inflexion, CVC funds trading above NAV, says secondaries marketplace

Inflexion's 2010-vintage buyout fund is trading at nearly a quarter above NAV, according to Palico

Odewald acquires Langer & Laumann Ingenieurbüro

Odewald invests via its second fund, Odewald KMU II, which closed on its hard-cap of €200m in 2015

Secondaries: all systems go following bumper 2017

Following a slump in 2016, the global volume of PE secondary transactions increased last year to reach new records

Value4Capital holds €80m close for Poland fund

Commitments include funds from EIF and EBRD, as well as capital from private Polish investors

Advent International to buy French telecoms business Circet

GP acquires the asset from majority backer CM-CIC Investissement, Omnes, founders and management

Felix leads $20m round for Heetch

Via ID and Alven Capital both took part last time and have reinvested along with Idinvest

Equistone sells Concept Life Sciences to Spectris for £163m

Equistone formed Concept Life Sciences through a hat-trick of acquisitions in 2014