Articles by Greg Gille

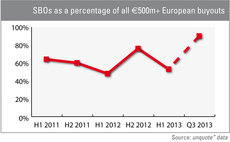

SBOs account for 90% of €500m+ dealflow in Q3

The latest quarterly figures from unquote" data show that while the wave of secondary buyouts seems to have hit its apex in overall volume terms, such deals are still disproportionally prominent in the large-cap space.

French GPs dodge bullet on foreign LP taxation

The French parliament has rejected a proposal to withhold 30% of distributions to foreign LPs invested in French private equity funds.

Advent secures Nocibé deal

Advent International and the Kreke family, which together own German retail group Douglas Holding, have entered exclusive talks to buy French perfume chain Nocibé from Charterhouse.

Equistone buys Européenne des Desserts in SBO

Equistone Partners has acquired French desserts maker Européenne des Desserts from Azulis Capital and Céréa Partenaire.

Will Woodford launch a private equity fund?

The UK's most famous fund manager could run a closed-ended private equity fund when he launches his own firm next year following his departure from Invesco Perpetual, allowing him to develop his passion for investing in start-up companies.

Advent's Douglas close to Nocibé deal

German retailer Douglas Holding, a portfolio company of Advent International, is reportedly close to acquiring French perfume brand Nocibé from Charterhouse.

Linklaters PE duo Bagshaw and Youle quit to join White & Case

Ian Bagshaw, White & Case

Fondations Capital takes over CM-CIC LBO Partners

Fondations Capital has acquired fellow French GP CM-CIC LBO Partners from CM-CIC Capital Finance, the private equity arm of the Crédit Mutuel-CIC banking group.

Equistone nears Européenne des Desserts SBO

Equistone Partners is set to acquire French desserts maker Européenne des Desserts from Azulis Capital and Céréa Partenaire, according to reports in the local press.

Montefiore smashes target for latest fund

French mid-cap GP Montefiore Investment has closed its third fund on its €240m hard-cap, well beyond its initial €180m target.

Ardian arranges €275m unitranche facility for Flexitallic SBO

Ardian (formerly Axa Private Equity) has arranged a €275m multi-currency unitranche facility to finance the €450m buyout of Flexitallic by Bridgepoint, in what marks the first investment for Ardian's Private Debt Fund III vehicle.

Former LBO France partners launch debt-focused Kartesia Advisor

Kartesia Advisor, a new firm founded by three former LBO France partners and an ex-ICG director, has held a first close on €225m for its maiden debt vehicle.

3i's Go Outdoors in £33m refinancing

Go Outdoors, a UK-based outdoor activities equipment retailer backed by 3i and YFM Private Equity, has secured a new £33m debt facility from Barclays.

PE backers mull Ceva Santé Animale sale

French veterinary laboratory Ceva Santé Animale, backed by Nixen, Euromezzanine and Sagard, has mandated Lazard to explore the possibility of a sale in the first half of 2014.

Axa spinout Ardian closes fifth LBO fund on €2.41bn

Ardian (formerly Axa Private Equity) has closed its LBO Fund V on €2.41bn, shortly after finalising its spinout from parent company Axa.

LPs highlight continued relevance of French private equity market

French Renaissance

Alven et al. inject €1.2m into Algolia

Alven Capital, Index Ventures, Point 9 Capital and private investors have provided French search engine Algolia with a €1.2m round of funding.

PAI partners collects third of €3bn fundraising target

French private equity house PAI partners has raised in excess of €1bn for its new buyout fund, according to French daily Les Echos.

Axa Private Equity spinout goes ahead

Insurer Axa has completed the sale of its private equity arm to a management-led consortium for €510m.

Iris Capital hires two investment managers

French VC firm Iris Capital has hired Gil Doukhan and Julien-David Nitlech as investment managers.

Fundraising: Germany's drawing power

The number of funds raised by German players – and the amount of capital they have been able to draw in – has increased steadily in the post-crash years.

ICG refinances Exclusive Networks

Intermediate Capital Group (ICG) has provided a senior debt package to refinance Omnes Capital-backed Exclusive Networks.

Club Med takeover pushed back to earliest March 2014

Axa Private Equity and Chinese conglomerate Fosun have suffered a setback in their plan to take French holiday resorts operator Club Med private, as a court of appeal will not rule on minority shareholders' opposition to the deal before March 2014 at...

Graphite Capital hits £475m target in six months

UK mid-market investor Graphite Capital has held a £475m closing for its latest vehicle, GCP VIII. A handful of potential additional commitments could bring the total to more than £500m within the next few weeks.