Articles by Greg Gille

Nextstage in €15m round for Cap Cinema

Nextstage has taken part in a €15m funding round for French multiplex operator Cap Cinema.

French VCs invest €12m in Fermentalg

BPI France, Viveris Management and IRDI have taken part in a €12m fundraising round for biotechnology company Fermentalg, alongside existing investors.

Dennison leaves Providence for Park Square Capital

Credit investor Park Square Capital has hired Piers Dennison, formerly managing director at Providence Equity Partners, as head of investor relations.

DBAG invests €5m in DNS:Net

Deutsche Beteiligungs (DBAG) has invested an initial €5m in German telecommunications and IT services provider DNS:Net.

Private equity still greedy for restaurants & bars sector

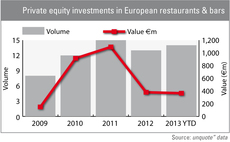

The buyout of Côte Restaurant by CBPE adds to an already busy year for investments in the eating and drinking sector, with activity recorded so far in 2013 already exceeding that of the whole of last year.

BPI France et al. inject €4.6m into Tommy's Diner

French investors BPI France, Midi Capital and Multicroissance have invested €4.6m in American-style restaurant chain Tommy's Diner.

Exponent's Trainline in £190m dividend recap

Trainline, a UK train ticketing website backed by Exponent Private Equity, has secured a £190m refinancing.

Edmond de Rothschild Capital Partners loses de Montgolfier and Fouque

Managing partners Eric de Montgolfier and Erick Fouque have left French GP Edmond de Rothschild Capital Partners (ERCP), to be replaced by Bertrand Demesse and Louis-Antoine Roullier.

Isatis injects €2.4m into Ispa MBO

Isatis Capital has invested €2.4m in the leveraged management buyout of French project management consultancy Ispa Consulting, in what marks the GP's last deal under the BNP Paribas Private Equity moniker.

InnovaFonds injects €3m into Icape

InnovaFonds has invested €3m in French circuit boards manufacturer Icape.

Private equity misses out on Lucozade, Ribena sale

GlaxoSmithKline (GSK) has agreed to sell popular drinks brands Lucozade and Ribena, which had attracted interest from buyout houses including Blackstone and Lion Capital, to Japanese trade player Suntory for £1.35bn.

LBO France adds MD to operating team

Etienne Colas, LBO France

Blackstone and GIC to acquire Rothesay stakes

Blackstone and Singaporean sovereign wealth fund GIC are set to each buy a 30% stake in UK-based insurer Rothesay Life from Goldman Sachs, according to reports.

Capitem holds €20m first close for maiden fund

French private equity house Capitem Partenaires has held a first close for its maiden fund on €20m.

Omnes finalises spinout, secures €70m commitment for new fund

Omnes Capital, the former private equity arm of French bank Crédit Agricole, has started raising its fourth SME-focused fund and is now wholly owned by its management team.

PE-backed Fläkt Woods to sell subsidiary for €193m

Fläkt Woods, a global air treatment and ventilation provider backed by Sagard and Equistone, has received a firm €193m offer for its Infrastructure & Industry activity.

3i-backed Action in €275m refinancing

3i stands to reap a £58m dividend from the €275m refinancing of Dutch portfolio company Action.

Sagard invests in Santiane

Sagard has taken a minority stake in French online insurance broker Groupe Santiane, while previous backer BNP Paribas Private Equity has exited the company.

Idinvest et al. in $20m round for Vestiaire Collective

Idinvest has joined existing investors Balderton Capital and Ventech in a $20m series-C round for French start-up Vestiaire Collective, led by publishing group Condé Nast.

Isai raises €50m for second fund

French VC Isai has held a final close on €50m for its second fund, Isai Expansion.

Adveq opens London office

Funds-of-funds manager Adveq has officially opened its new London office.

CDC appoints ex-Permira partner as chairman

Graham Wrigley, CDC

Large VC rounds: France outpaces neighbours

France was home to six of the 20 largest venture investments completed so far this year in Europe, with Germany following closely behind.

BNP Paribas carves out direct PE arm

Team members of BNP Paribas Private Equity have created a new company to manage the GP's direct funds, while the French bank will remain in control of the funds-of-funds business.