Articles by Greg Gille

GE Capital and Ares refinance Astorg's Ethypharm

GE Capital and Ares Management have provided Astorg Partners portfolio company Ethypharm with a €170m unitranche facility.

Women still under-represented in French investment teams

Although French private equity houses are increasingly trying to address the situation, women remain vastly under-represented in investment teams and in more senior roles, according to the latest survey by Deloitte and trade body AFIC.

Octopus leads £3.8m round for Kabbee

Octopus Investments and Moneysupermarket.com founder Simon Nixon have provided Kabbee, a price comparison app for London minicabs, with a £3.8m series-A round of funding.

Auriga holds €40m first close for Bioseeds fund

French VC Auriga Partners has held a first close on €40m for its latest vehicle, Auriga IV Bioseeds, after seven months on the road.

Argos Soditic buys Cisbio Bioassays

Argos Soditic has backed the €25m management buyout of French biotech company Cisbio Bioassays.

Ontario Teachers' Pension Plan to buy Burton's Biscuits

Ontario Teachers' Pension Plan has agreed to acquire UK-based Burton's Biscuits, which makes confectionery including Wagon Wheels and Jammie Dodgers, via its private equity arm Teachers' Private Capital.

Terra Firma reaps £234m in Infinis IPO

Terra Firma portfolio company Infinis Energy has listed on the London Stock Exchange in an IPO valuing the business at £780m.

Terra Firma appoints MD in renewables team

Private equity house Terra Firma has hired Ingmar Wilhelm, the former executive VP at energy company Enel Green Power, as a financial managing director in its renewable energy investment team.

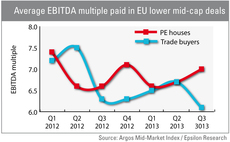

Lower mid-cap uptick bolsters valuations

Private equity buyers have been more bullish than their corporate counterparts on pricing in the third quarter, according to the latest Argos Mid-Market Index. Greg Gille reports

Permira's Just Retirement valued at £1.1bn in IPO

Permira-backed Just Retirement has begun trading on the London Stock Exchange at £2.25 per share, giving the business a market cap of £1.125bn.

KKR to reap up to €564m in Tarkett IPO

French flooring and sports surface maker Tarkett, backed by KKR, has set an indicative price range of €27.75-33.90 for its upcoming IPO on the NYSE Euronext Paris.

JZCP targets Spain with new joint venture Toro Finance

Listed private equity fund JZ Capital Partners (JZCP) has teamed up with Avenue Capital Group to launch a new €400m finance company in Spain.

Numericable raises €652m in IPO

Cinven- and Carlyle-backed Numericable has made its debut on the NYSE Euronext Paris with a €3bn market cap.

European private equity activity drops to 2005 lows

Findings from the latest unquote” Private Equity Barometer, published in association with SL Capital Partners, reveal a worrying drop in deal volumes, falling to the same level as Q4 2005.

Ardian provides unitranche for Européenne des Desserts buyout

Ardian (formerly Axa Private Equity) has arranged a €70m unitranche facility to finance Equistone's buyout of Européenne des Desserts from Azulis Capital and Céréa Partenaire.

Flying the nest: New wave of French spinouts

Following a decade of French spinouts from banks and insurance companies, the last few weeks have seen some of the most high-profile carve-outs to date. Greg Gille reports

Indigo Capital France hits €210m first close for new fund

Indigo Capital France has held a first close on more than €200m for its first mezzanine fund following the team's spinout from UK-based Indigo Capital.

Nordwind sells SHW stake

Nordwind Capital has sold its remaining 58% stake in listed German automotive supplier SHW for €132.6m, according to reports.

Teachers' Private Capital buys Busy Bees

Teachers' Private Capital (TPC), the private equity arm of pension fund Ontario Teachers' Pension Plan, has acquired UK-based nursery group Busy Bees.

G4S rejects £1.55bn offer for subsidiary from Charterhouse

The board of G4S has rejected a "highly opportunistic" £1.55bn offer from Charterhouse for its cash solutions unit.

Exit of Links stars puts focus on magic circle's struggle to break into PE market

With a host of US firms looking to ramp up their private equity practices in the UK, can their City rivals compete? Legal Week's Anna Reynolds reports

Apax takes over French education business Inseec

Apax France has agreed to acquire Inseec, a French business and management schools operator, from listed US player Career Education Corporation in a €200m deal.

PE-backed TDF attracts €3.5-3.6bn offers

The private equity backers of broadcast tower operator Télédiffusion de France (TDF) are considering bids in the region of €3.5bn for the sale of the firm’s French unit, Reuters has reported.