Articles by Harriet Matthews

Speedinvest launches EUR 80m Climate & Industry Opportunity fund

Fund is intended to back the VC's existing industrial and climate technology startups

IK to buy Renta Group from Intera

Intera formed the construction machinery and equipment firm in 2015 via a three-company merger

Tenzing raises GBP 100m Belay Fund

Vehicle can invest up to GBP 150m and will back the GP's Tenzing II portfolio companies

VCs in USD 156m round for Quell Therapeutics

Series B for the Treg therapy developer was led by VCs including Jeito Capital and Ridgeback Capital

Searchlight invests in Celestyal Cruises

Searchlight is investing in the cruise operator via its Searchlight Opportunities Fund

LBO France buys ID Market, Sourcidys

GP is investing via its Mid Cap strategy and will merge the B2C and B2B home and gardening retailers

Golding hires Schütz as ESG director

Christian Schütz joins from his role as senior vice-president of credit research at Pimco

Capiton holds EUR 504m final close for sixth fund

Capiton VI is now 36% deployed across seven deals and expects to make up to 15 platform investments

CVC exits Etraveli in EUR 1.63bn trade sale

CVC acquired the online flight booking platform from ProSiebenSat.1 in 2017 in a EUR 508m deal

Advent, Centerbridge to launch Aareal Bank takeover

Advent already owns a stake in Aareon, the property ERP software unit of Aareal Bank

Waterland opens Spanish office

GP has hired David Torralba as principal and head of Spain, plus Guillermo Galmés as senior advisor

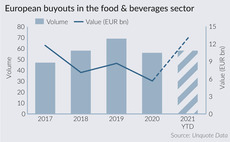

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

Advent buys Caldic from Goldman Sachs

GP plans to merge the speciality chemicals producer with São Paulo-headquartered Grupo Transmerquim

UVC holds final close for third fund

UVC Partners has a deployment capacity of EUR 255m with its flagship fund and new Opportunity Fund

CVC buys Unilever's tea business for EUR 4.5bn

European food and beverage buyouts are now set to reach EUR 13bn in 2021, according to Unquote Data

Bain gears up for sixth European buyout fund

US-headquartered GP held a final close for its previous European fund in 2018 on EUR 4.35bn

ArchiMed buys Cardioline

Cardiology telemedicine platform is the first deal from the GP's EUR 650m MED III fund

Balderton raises USD 600m for eighth flagship fund

Fund will continue the VC's Series A-focused strategy, targeting European startups

Sofinnova holds EUR 150m close for third biotech fund

Impact fund has made two investments as of its interim close and expects to make 10-12 in total

Waterland sells Cawood for 3.7x money

Trade sale to EBI is the first exit from the GP's GBP 2bn, 2017-vintage fund Waterland VI

ICG to exit Park Holidays in GBP 900m trade sale – report

ICG acquired the caravan holiday park operator in a GBP 362m SBO from Caledonia Investments in 2016

GP Profile: Adelis steps up deal-making after latest fund close

Co-managing partner Jan Åkesson and head of IR Adalbjörn Stefansson speak to Unquote about the Nordic mid-market-focused GP's fundraise and deployment plans

Adelis III holds EUR 932m final close

Stockholm-headquartered GP's predecessor fund held a final close in 2017 on EUR 600m

Monterro 4 holds EUR 700m final close

GP will now be making new platform deals from the fund, continuing to focus on Nordic B2B software