Articles by Harriet Matthews

Exponent buys majority stake in H&MV

Limited structured sale saw the GP acquire the Irish high voltage electrical engineering firm

Ardian sells ProduceShop stake to Gilde Buy Out

Ardian Growth bought a minority stake in the Switzerland-based home goods e-commerce firm in 2020

Apax gears up for Fund XI

Apax Partners' USD 11bn predecessor flagship fund was 64% deployed as of September 2021

Inflexion sells Alcumus to Apax for 5.9x money

Inflexion acquired the UK-based risk management and compliance firm for GBP 92m in 2015

Warburg Pincus leads USD 150m round for Scandit

Switzerland-headquartered barcode scanning software is valued at more than USD 1bn

Nuveen closes impact fund on USD 218m

GP could return to market for Fund II in 2022 or early 2023 given current deployment opportunities

Inflexion acquires Enviolo in USD 245m buyout

Investment in the Netherlands-based e-bike components producer was led by the GP's Amsterdam office

Hamilton Lane opens Swiss office

EMEA head of client solutions Ralph Aerni and vice-president Rainer Kobler will head the initiative

Polestar launches circular debt fund with EUR 400m hard-cap

Fund will back Netherlands-based projects and companies involved with carbon and waste reduction

BC Partners announces EUR 6.9bn fundraise for BC XI

Final close fell below the original target;Т GP expects to return to market for its next fund in H2 2023

Eight Advisory opens Cologne office; appoints KPMG's Luchtenberg

Fourth German office will be headed by Curt-Oliver Luchtenberg, who has joined from KPMG

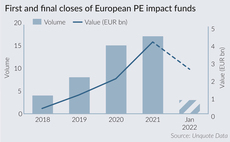

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

Baird sells Nigel Wright majority stake to management

Baird will retain minority stakes in the recruitment firm, having first acquired it in 2010

Tikehau records EUR 6.4bn in fundraising in 2021

GP deployed EUR 5.5bn from its private equity, private debt and real estate funds in the same year

Access Capital registers ninth growth buyout fund

Fund-of-funds strategy makes primary and secondaries deals, backing funds investing in European SMEs

CapMan commits to science-based targets for net zero

Commitment is part of the GP's ESG strategy across the firm itself and its portfolio

Coller to close USD 1.4bn debut credit secondaries fund

GP launched its first dedicated secondaries fund in May 2021 and has commitments from around 30 LPs

Polaris V holds final close on EUR 650m hard-cap

Fund has EUR 690m to deploy including the GP commitment, and has made five platform investments

Permira leads USD 180m round for GWI

London-headquartered market research software-as-a-service platform is valued at more than USD 850m

Abris exits Patent Co to trade

Sale to Raiffeisen Ware Austria ends Abris's six-year investment period in the animal feed company

Carlyle sells Cupa Group to Brookfield

GP bought the natural slate producer in 2016 for EUR 170m; it is now reportedly valued at EUR 900m

Pinova buys Sematell from IMCap

Small-cap technology investor IMCap bought Sematell in a carve-out from Attensity in 2015

CVC co-founder Koltes to step back in 2022

Steve Koltes co-founded CVC in 1993 and is to step back from an active role from 1 October 2022

Bencis to buy chemicals company Höfer Chemie

GP plans to acquire a majority stake in the business, according to a competition authority filing