Articles by Harriet Matthews

Riverside hires Cole as fundraising and IR head

Allison Cole was previously head of fundraising and investor relations at Lightyear Capital

Argos Wityu exits Olinn

GP formed the equipment leasing and management firm in 2018 via the merger of four companies

EQT acquires LSP, forming EQT Life Sciences

Announcement follows Life Sciences Partners' seven-month, EUR 850m fundraise for LSP VII

Investindustrial sets SBTs for emissions

GP has also committed to achieving net zero greenhouse gas emissions in its funds

IK buys Truesec from Sobro

Cybersecurity firm is IK's seventh platform investment of H2 2021 and its fourth deal since October

PE-backed Inmarsat sold to Viasat in USD 7.3bn deal

Apax Partners, CPP, OTPP and Warburg Pincus acquired Inmarsat via a take-private in 2019

Zooplus takeover to go ahead as 80% threshold is met

H&F and EQT Private Equity teamed up for a joint final offer for the pet products retailer in late October

PAI exits Atos Medical in EUR 2.2bn trade sale

PAI acquired the laryngotomy and tracheostomy care products company in an SBO from EQT in 2017

Ardian, Latour buy LBO France's Groupe RG

LBO France bought a majority stake in the personal protective equipment producer in 2017

HealthCap looks to future growth after new appointments

Venture capital firm HealthCap is looking ahead to a busy healthcare and life sciences market

Aurelius buys McKesson UK in GBP 477m deal

Carve-out of McKesson UK includes LloydsPharmacy and is Aurelius's largest deal to date

Ufenau registers third continuation vehicle

Switzerland-headquartered Ufenau Capital Partners invests in services-focused SMEs

Palatine sells Estio to PE-backed BPP

Deal is the first exit from Palatine's first Impact Investing fund, which closed in 2017 on GBP 100m

LP Profile: ACP opens up PE programme

Co-head of PE Michael Lindauer speaks to Unquote about the LP's allocation strategy and its approach in an increasingly competitive market

Vast majority of LPs plan to increase impact allocations – survey

HarbourVest's 2021 ESG, Sustainability, and Impact Investing Survey collated responses from 130 LPs

Procuritas backs Strandberg Guitars

GP is backing the headless guitars producer via its EUR 318m Capital Investors VI fund

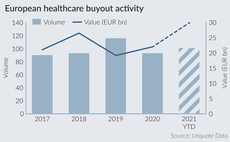

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

France's Apax appoints chief sustainability officer

Dominica Adam has taken up the newly created management position at the Paris-headquartered GP

IK invests in Prophecy Group

Minority investment in the cybersecurity firm is IK's sixth deal to be announced in H2 2021

Tenzing sets sights on Nordic countries

Unquote catches up with managing partner Guy Gillon following the appointment of Magnus GottУЅs to lead Tenzing's Nordic expansion

CapMan Wealth Services forms Investment Partners Fund

EUR 90m fund will invest in cooperation with AlpInvest, backing US mid-market funds chosen by the GP

IK Partners buys Plastiflex

GP is investing via its EUR 1.2bn Small Cap III fund, which backs companies valued at EUR 15m-150m

Triton forms LeDap Group

Company has been formed by more than 30 acquisitions; it aims to promote racquet sport padel

Allianz holds EUR 520m first close for PE fund

Private equity fund will invest alongside Allianz's core private equity programme