Articles by Harriet Matthews

DBAG acquires Congatec

MBO of the computing and robotic components producer is the second deal from DBAG Fund VIII

Waterland's Beck Et Al buys InfoWan

IT cloud service group now comprises four businesses and was formed by Waterland in May 2020

CVC's Syntegon sells Viersen-based operations to trade

CVC acquired Syntegon Technolgy in a carve-out from Robert Bosch in 2019 via its seventh fund

Adiuva-backed Konzmann acquires Trenker

Building services provider has made 12 add-ons since Adiuva Capital first invested in 2016

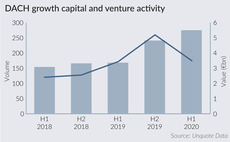

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Ceecat Capital on road for Fund II

Vehicle is the first to be raised since Ceecat Capital span out from ADM Capital in 2018

Gilde's Raak Metals buys Stolwerk Metaal

Add-on is the first since GIlde Equity Management bought a majority stake in Raak in February 2020

LDC's Onecom bolts on Glamorgan Telecom Group

Add-on is the first since LDC and Ares provided financing of ТЃ100m to the telecoms company in 2019

Deutsche Beteiligungs AG acquires Multimon

Acquisition of the fire safety systems provider is the first from the GP's €1.1bn eighth fund

Advent buys 30% stake in Aareon

Deal gives the property software company an EV of €960m, with Advent's stake valued at €260m

Debt funds making inroads in DACH amid Covid-19, says GCA

GCA's Mid Cap Monitor shows that debt funds financed 71% of German LBOs in H1 2020, with the firm expecting an activity uptick in Q4

NPM Capital's Bergman Clinics buys Van Linschoten Specialisten

Add-on comes after Mergermarket reported that the sale of Bergman had been suspended in March 2020

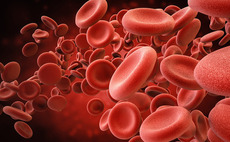

Occident leads CHF 5.1m series-A for Hemotune

Also backing the biotech startup were the Zürcher Kantonalbank and Greencross Medical Science Corp

VCs in €5m round for Klima

EVentures, 468 Capital and HV Holtzbrinck back the round for the climate change mitigation app

Arsenal Capital Partners acquires Cello Health

Acquisition values Cello at ТЃ181.8m and will form part of the GP's healthcare consultancy platform

La Famiglia announces second fund

B2B-focused venture capital fund has made eight investments so far and is targeting €50m

HQ Equita buys majority stake in Muegge

Microwave components producer was acquired from its parent company Meyer Burger Technology

VCs sell stakes in Kandy Therapeutics to Bayer

Backers included Advent Life Sciences, Fountain Healthcare Partners, Forbion, OrbiMed and Longitude

Bolster Investments buys minority stake in Infoplaza

Weather data provider uses the proceeds to fund the acquisition of market peer Weeronline

Kester Capital closes second fund on £90m

GP also announced the refinancing of online gardening retailer YouGardem, scoring a 60% cost return

Bid Equity buys majority stake in Infopark

Deal is the second from Bid Equity II, which held a close in November 2019 and targets B2B software

DvH Ventures launches Digital Health Fund

Dieter von Holtzbrinck Ventures (DvH Ventures) has announced the launch of its first Digital Health fund, which has held a first close on €60m.

Rigeto Unternehmerkapital acquires Oehm & Rehbein

Acquisition of Germany-based x-ray equipment and software was backed by senior debt from ApoBank

Triton's All4Labels buys GPS Label, Rotomet

Following the acquisition, GPS-Rotomet will operate under All4Labels, which Triton acquired in 2019