Articles by Francesca Veronesi

Experienced Capital backs NV Gallery

NV Gallery founders Natalie Hanczewski and Thibaut Saguet retain a majority stake

Index Ventures leads €30m series-B for Lunchr

Daphni and Idinvest previously invested €11m in the France-based startup in Q2 2018

Keensight inks first Spanish deal with Asti Mobile Robotics

French GP Keensight enters the Spanish market with a growth capital investment

Three Hills closes third fund on €540m hard cap

THCS III exceeds its тЌ400m target, attracting LPs from Europe, North America and Australasia

Cathay backs Finance Active

Finance Active’s founders and managers also acquire stakes in the digital finance business

Eurazeo holds first close on €500m for Capital IV

Asset managers, sovereign wealth funds, insurance companies and family offices back the fund

Permira buys Hana Group in SBO

GP buys France-based Hana Group, based on 2019 projected EBITDA of €43m, from TA Associates

CM-CIC backs Septeo MBO

GP, buying a minority stake, will help France-based Septeo to grow internationally

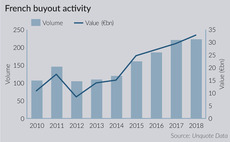

French buyout value climbs to post-crisis peak

Total deal value comfortably surpasses 2017's figure in a market driven by fierce competition, high prices and easy access to debt

IK backs NetCo MBO

IK, drawing capital from its Small Cap II Fund, invests alongside historical backer Andera

Main Mezzanine spins out as Pride Capital

As Pride Capital, the rebranded mezzanine provider will maintain the same investment strategy

CM-CIC Innovation et al. invest €7m in Diota

Safran Corporate Ventures, Supernova Invest and Calao Finance reinvest in the company

Bridgepoint acquires Miya from Arison Investments

Miya's acquisition is the first investment made by Bridgepoint's €5.7bn Europe VI fund

BPI France, CM-CIC back Bretagne Télécom

GPs inject €20m into telecoms specialist Bretagne Telecom in the form of equity and debt

Apax France sells aviation division of SK FireSafety

US-based LLCP carves-out SK AeroSafety division from Apax France's SK FireSafety Group

Idia backs LGI Wines in SBO

Historical backers Initiative & Finance and Agribev Holding divest their LGI Wines stakes

Siparex backs Valentin Traiteur in MBO

GP uses the Siparex ETI 4 fund to acquire its stake in Valentin Traiteur, a fresh food provider

Siparex sells stake in Cotherm to trade

Siparex sells its majority stake in Cotherm, acquired in 2012, to heat exchangers specialist Thermofin

Eurazeo sells stake in Capzanine to Axa in €82m deal

Axa France recommits having backed Capzanine since 2015; Axa IM is a new backer

Natixis et al. invest €72m in Wynd

Fresh capital will be used to hire staff, pursue Wynd's expansion abroad and invest in R&D

Capzanine backs Intescia in SBO

Exiting GPs Andera and BNP Paribas Development supported Intescia's spin-out in 2013

Naxicap exits Jaguar Network to trade in €100m deal

GP sells minority stake in France-based Jaguar Network after five years' ownership

Charterhouse's Siaci Saint Honore bolts on Driesassur

SSH, backed by Charterhouse since 2018, bolts on jewellery insurance specialist Driesassur

BEX collects $280m for third fund

BEX III should hold a first and final close by Q2 2019 near its $350m hard-cap