Articles by Katharine Hidalgo

UK industry welcomes rescue package, but concerns remain

Package includes ТЃ330bn in loans, ТЃ20bn in other aid and a postponement of business rates

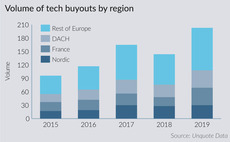

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached

Axia buys insurance business Direct Gap

Gordons provides legal advice and Naylor Wintersgill provides financial due diligence services

CBPE sells SpaMedica to Nordic Capital-backed Ober Scharrer

Nordic Capital is currently investing from its ninth fund, Nordic Capital IX, which closed on тЌ4.3bn

ECI-backed IT Lab acquires Sol-Tec

Unquote understands ECI Partners provided no fresh equity for the acquisition of Sol-Tec

UK sees advisory boom amid PE market maturation

UK & Ireland sees an increase in the number of corporate finance firms participating in PE deals to more than 160

ESO backs facilities service Churchill

Current executive directors Joel Briggs and Phil Moxom will continue to lead the company

Chiltern acquires Doby Verrolec

Chiltern is an evergreen investor that provides equity cheques of ТЃ3-15m of equity

TDR, Lone Star and Apollo make bids for Asda

Walmart is selling its majority share of the company and could command more than ТЃ7bn for the asset

New perspectives: How secondaries are reshaping PE's risk profile

With LPs increasingly hungry for PE, the boom of the secondaries market can shift perceptions around the risks associated with the asset class

YFM invests in ISS

Founded in 2009 and based in Pershore, West Midlands, ISS currently employs 31 people

Arbor-backed Steelite acquires William Edwards

Both companies will continue to operate from their current facilities in Stoke-on-Trent

VC-backed Red Driving School acquires NFE

Founded in 2003, NFE Group is a provider of fleet driver training services across the UK

Agilitas acquires Learning Curve from MML

Founded in 2004, Learning Curve is based in Durham and offers training and apprenticeships

CD&R-backed Capco bolts on Creative Construction

CD&R acquired a 60% stake in Capco Consulting Business from FIS for $477m in 2017

Rockpool invests in MomentumABM

Rockpool is a growth equity investor that invests in profitable UK-based companies

YFM exits GroupBC investment

YFM Equity Partners injected ТЃ3.35m into the company in 2014, carving it out from Unit4

Causeway's Bakers + Baristas and Patisserie Valerie merge

Causeway acquired Patisserie Valerie, a part of Patisserie Holdings, in February 2019

Dunedin's FRA secures £100m refinancing

FRA recently opened offices in the Nordic region, as well as in New York, Dallas and Philadelphia

MML sells Altius to Avanade

Avanade recently acquired Germany-based Alnamic, a provider of business transformation services

Advent-backed Rubix acquires Barlotti, Walter Gondrom

Unquote understands the acquisitions were not backed by fresh equity from the firm

TA- and Hg-backed Access acquires JMI-backed CoreHR

Alongside JMI Services, US-based private equity firm JMI Equity invested in CoreHR in January 2016

Limerstone buys Patricia Whites and Country Cousins for £14m

Grant Thornton was engaged to explore an auction process for the assets in December 2019

BGF and Coutts announce UK Enterprise Fund

Specific initiatives and programmes will be put in place to support female-led businesses