Articles by Katharine Hidalgo

Notion Capital leads $12m series-A for HeyJobs

Notion Capital typically leads funding rounds with a first investment of $3-5m in startups

KGAL to invest in private equity and expand investor base

KGAL has 72,000 investors from Germany, the UK and France, of which 211 are institutional investors

BioGeneration, Wellington lead €30m series-A for Confo

Fund+ and Perceptive Advisors, Capricorn, Qbic, PMV, Mints, V-Bio Ventures and VIB joined the round

Afinum exits Sinnex in trade sale

Afinum has already realised two investments from its Fünfte vehicle: CaseKing and D&B

Maxberg acquires Starface

Maxberg invests €10-100m in companies in the DACH region and has a total fund volume of €600m

Panakès Partners in CHF 9.5m round for SamanTree

Panakès Partners is using equity from its Fund I, which invests €5-6m in European startups

Sequoia, Spark Capital lead $47m series-C for Tourlane

Existing investors in Tourlane include NFQ Capital, DN Capital and HV Holtzbrinck Ventures

Capvis-backed Wer Liefert Was bolts on Gebraucht.de

Business angels including Peter Schmid, Kai Hansen, Marcus Börner and Jan Kemper were investors

Capiton Acquires GPE Group

GPE Group is the ninth company in Capiton V's portfolio, which includes BWTS and Ispin

DBAG invests in Cloudflight

DBAG has co-invested approximately €8m from its balance sheet, for a 12% stake in Cloudflight

H&F, Blackstone's take-private of Scout24 stalls – reports

Shareholders resist a voluntary takeover offer following a rise in Scout24's share price

EQT exits Avenso in management buy-back

EQT acquired a majority stake in Avenso in 2013 and has expanded the company's product portfolio

Marondo Capital acquires stake in Oxid eSales

Current shareholders in Oxid eSales include IBG, Marondo Capital and the company's CEO

Consortium invests CHF 12.5m in Alentis

BioMedPartners, BB Pureos Bioventures, BPI France, Schroder Adveq and HTGF participate in the deal

DPE invests in Massenberg

DPE is currently investing from DPE Duetschland III, which held a final close on €575m in 2017

LDC appoints two directors

Ul-Haq joins from Deloitte, while Alderson has been working at LDC since 2012 in the Yorkshire team

21 Invest France acquires FMA Assurances

21 Invest France invests in French companies providing tickets in the €20-50m range

VCs sell Parlamind

Investors include Motu Ventures, Asgard Capital, Angelfund.vc and business angels

Nord Holding sells stake in Avista Oil

Family office Bitburger Holding and entrepreneur Susanne Klatten's investment arm acquired the stake

Hannover Finanz acquires stake in Lacon Electronic

Hannover Finanz targets medium-sized enterprises with annual sales of at least €20m

Espira acquires Icon

Icon was acquired from the joint administrators of former energy broker Utilitywise

HV Holtzbrinck leads $19m series-A for Zencargo

Investors include Pentland Ventures, Tom Stafford, Picus Capital, LocalGlobe and Samos Investments

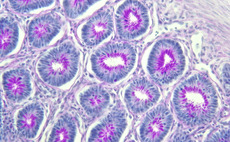

VCs in funding round for Cevec

Peppermint Venture, NRW Bank and Creathor Ventures raised €4.5m for Cevec in 2015

Concerning prognoses for German healthcare

Uncertainty around new regulation in the healthcare sector has caused jitters among investors