Articles by Mariia Bondarenko

Summit-backed Viroclinics acquires DDL

Bob van Gemen, CEO of Viroclinics Biosciences, will serve as CEO of the combined organisation

Advent hires new lead for European consumer team

Chavanne joins from TowerBrook, where he most recently served as a managing director

IK appoints Salmon as partner in small-cap team

Tom Salmon will primarily focus on the origination of investment opportunities in the UK

Checkout.com acquires VC-backed ProcessOut

Insight Partners and DST Global led a $230m series-A funding round for Checkout.com last year

Georgian leads $25m series-C for Tractable

Series-C funding round nearly doubles the total funds raised by the company to $55m

Innovestor holds first close for industrial fund

Fund has a focus on sectors benefiting from the fourth industrial revolution

Bain & Co joins CVC to back EcoVadis

Bain & Co's investment was coupled with the recently secured $200m funding from CVC Growth Partners

Demeter, Allianz France in €23.6m series-C for Cityscoot

Fresh capital will helf finance the expansion into two new European cities in 2020

Dunedin appoints Blackhall and Morrison

Claire Blackhall and James Morrison joined the company in 2019

Isai, Capgemini join €12m round for Toucan Toco

Isai and Capgemini invested through their joint investment fund Isai Cap Venture

LPeC appoints Botwood Smith as CEO

UK-based Listed Private Capital (LPeC) has appointed Deborah Botwood Smith as its chief executive

Apax-backed Idealista acquires Yaencontre

Apax Partners acquired a stake in Idealista from Bonsai Venture Capital et al. in July 2015

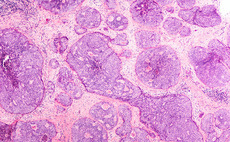

Vesalius, Swisscanto in €19m series-B for OncoDNA

Fresh capital will be used for international growth and software development acceleration

Kinnevik leads $51.6m round for Mathem

Round also saw participation from AMF, which invested $28.9m

Wells Fargo in $28m series-B for Elliptic

WFSC joins a group of existing investors that committed to the round in September 2019

Shoe Investments, Knight Venture in €2.75m series-A for Dealroom

Funding will support Dealroom's continued international expansion in Europe and beyond

Prime Ventures, Tempocap in $36m series-B for CybelAngel

Prime Ventures partner Pieter Welten joins the risk management company's board of directors

Springtide, MCI exit Geewa

Geewa's founder and shareholder, Milos Enderle, also sold his remaining 6% stake in the company

NGP, ETF in €20m series-B for Shippeo

Fresh capital will be used to further strengthen the company's market position in Europe

Nordstjernan sells PriceRunner in management buy-back

Nordstjernan had owned PriceRunner since 2016, alongside Nicklas StorУЅkers and KarlтJohan Persson

Consortium in CHF 23m series-C for Lunaphore

Fresh capital will be used for market and product expansion in the US and Europe

PVP fully acquires Avenir Medical Poland

In May 2018, PVP acquired an initial 56% stake in AMP from the company's founders

RSBC acquires 50% stake in Umbrella

Pavel Steiner will remain CEO of Umbrella Invest Group, which will now operate under the new name

Highlander exits Akomex in management buy-back

Mezzanine Management, which is currently investing from its AMC IV fund, backs the management