Articles by Mariia Bondarenko

Notion leads $36m series-B for Dixa

Dixa's founders have reduced their combined stake by 15-20% in conjunction with the round

Smedvig leads $10m series-A for Yumpingo

Company plans to scale its one-minute instant review platform and launch Yumpingo Pay

BHS acquires DCK Holoubkov Bohemia

With the capital injection, the company plans to exploit the export potential and expand the product range

Horizon buys 6.8% stake in Bucharest-listed Purcari Wineries

Horizon Capital is currently investing from EEGF III, its 2017-vintage $200m fund

Level Equity, Vaekstfonden in $16.9m round for Monsido

Company will use the capital to expand in the North American, EU, and Asia-Pacific markets

Temasek leads $139m round for ManoMano

With the new funding round, the company plans to recruit 200 people in Barcelona and Bordeaux

Avallon holds €80.6m first closing for third fund

Fund completed its first deal, backing Poland-based household cleaning products manufacturer Clovin

RDIF et al. in Carprice, Travelata, Elementaree

RDIF is injecting capital jointly with its Russian, French and Middle Eastern partners

Consortium in €90m round for Tink

Insight Venture Partners previously led a тЌ56m funding round early last year

EI sells Danwood to trade for €140m

Enterprise Investors wholly acquired the company in a carve-out from Budimex in December 2013

Eight Roads et al. in €42.6m series-B for Funnel

Fresh capital will be used to accelerate Funnel's operations in the US and invest in its technical teams

Sequoia leads $45m series-B for Productboard

Round also saw participation from Bessemer Venture Partners and existing investors

Vendis appoints Riisberg as senior adviser in Nordic region

Christian Riisberg was previously founding partner of Alipes and a board member for various companies

Accel-KKR leads $50m round for Partnerize

Accel-KKR principal Joe Porten will join the Partnerize board of directors as a part of the deal

K Fund et al. in €3m round for Bob.io

Company plans to expand internationally and develop new services for passengers' needs

MCI to sell Netrisk

During MCI Group's holding period, the company bolted on Biztosítás.hu in 2019

Cartesian backs Simba Sleep

The fresh capital will be used to facilitate the company's expansion in China and Canada

IK acquires majority stake in MDT

GP drew equity from IK VIII to back the heating and ventilation components specialist

Apax invests in engineering software developer Graitec

Founder Francis Guillemard and the management team reinvested in the engineering company

EMK acquires majority stake in WAE

EMK will invest in the commercialisation of WAE's technology opportunities and long-term growth

Resource Partners acquires Maced

Tomasz Macionga will continue as CEO, while Edmund Macionga will join the supervisory board

Tesi et al. back $15m series-C for BC Platforms

Company will use the fresh capital to expand its global network of clinical and genomics data

Elbrus leads $10m round for YClients

Elbrus is currently investing from its $550m vehicle, which held a final close in February 2014

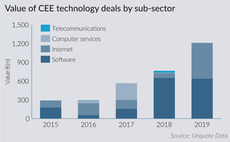

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3