Articles by Alice Murray

Arkéa invests €2m in Lyamtech

Arkéa Capital Investissement has invested €2m in orthopaedic footwear company Lyamtech.

Sarsia Seed et al. pump NOK 5.5m into Vaccibody

Norwegian pharmaceutical firm Vaccibody has received NOK 5.5m in funding from existing investors including Sarsia Seed.

Endless supports James Briggs MBO

Endless has backed the management buyout of aerosol and speciality chemical supplier James Briggs.

S&P launches mid-market assesment service

As banks continue to hold back lending for mid-market companies, Standard & Poor’s (S&P) has launched a European credit benchmark for the neglected market segment.

Catapult et al. invest in Monica Healthcare

Catapult Venture Managers, East Midlands Business Angels, New Hill Management and private investors have made a further cash injection into Monica Healthcare.

Lyceum's Adapt gets Sleek

Managed IT infrastructure provider Adapt, backed by Lyceum Capital, has acquired cloud hosting provider Sleek.

Bridgepoint secures £375m refinancing for Pret debt

Pret A Manger will pay out ТЃ150m to its private equity owner Bridgepoint following a dividend recapitalisation.

Tackling transparency and disclosure through data

While GP monitoring of portfolio companies becomes more sophisticated, LPs are demanding more granular insight into individual fund performance. The increasing demand for performance information begs several important questions: What data is required?...

HPS loan fund raises more than $3bn

Highbridge Principal Strategies (HPS) has closed its HPS Specialty Fund III with over $3bn in commitments.

Private equity circles D&G

Private equity firms including Blackstone, CVC and Clayton Dubilier & Rice are believed to be in a second round of bidding for Advent International's Domestic & General (D&G).

İş Private Equity offloads Aras Kargo stake

Turkey-based İş Private Equity has sold its 20% holding in parcel delivery group Aras Kargo to Austrian Post in a deal worth €50m.

Innogy, Aqton, HTGF invest in Kiwigrid

Innogy Venture Capital and Aqton, alongside existing investor High-Tech Gründerfonds (HTGF), have jointly invested in energy management start-up Kiwigrid.

The challenges of regional investing

Regional investing often means more opportunity for relationship-based deal doing, as highlighted in yesterday's story. But there are also challenges, as we explore here in the second installment of Alice Murray's two-part series.

Regional UK players closing the gap on London market

Life outside London

Tax avoidance debate turns to private equity

Tax avoidance is top of the agenda for the G8 summit in Northern Ireland and part of that discussion will concern UK private equityтs treatment of corporation tax.

Adveq to open London office

Swiss fund-of-funds Adveq is in the process of setting up a new office in London.

NVM supports CBio MBO

NVM Private Equity has invested ТЃ3m in the ТЃ4.4m management buyout of environmentally-friendly waste treatment business Cleveland Biotech (CBio).

CIC's head of PE sees opportunities in Europe

The challenging fundraising environment means it is a good time to target private markets, and Europe in particular, according to the head of China Investment Corporation's (CIC) private equity investment department.

Harris Williams opens Frankfurt office

Mid-market investment bank Harris Williams & Co has opened a second European office in Frankfurt.

LGV's Heywood steps down

LGV Capital CEO Ivan Heywood has stepped down and will be replaced by current managing directors Michael Mowlem and Bill Priestly.

Cinven tops up fifth buyout fund to €5.3bn

Cinven has held another final close on its fifth European buyout fund on €5.3bn.

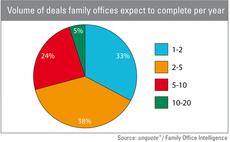

Family offices seek surge in deal origination

Family offices

Pricing secondaries: complex process or pure guesswork?

Pricing secondaries

Uniqa to sell $665m private equity portfolio

Austrian insurance company Uniqa Versicherungen is planning to offload $665m of private equity positions ahead of Solvency II.