Articles by Alice Murray

Herkules picks up Umoe Schat-Harding and Noreq

Herkules Private Equity has acquired life-saving equipment companies Umoe Schat-Harding and Noreq in a combined transaction.

UK private equity industry proves downturn resilience

UK private equity and venture capital funds generated a 6% 5-year IRR during the five years throughout the financial crisis, outperforming the 2.5% achieved by the FTSE All-Share, according to a recently published study.

EIF and KOSGEB launch €250m Turkish fund-of-funds

The European Investment Fund (EIF) and the Small and Medium Enterprises Development Organisation of Turkey (KOSGEB) have established a Turkey-focused fund-of-funds targeting €250m.

NVM achieves 3.3x on IG exit

NVM Private Equity has sold IG Doors to the HУЖrmann Group, generating an IRR of 17.3% and a 3.3x money multiple.

AA and Saga looking to refinance, then split

The AA group and Saga, backed by CVC, Charterhouse and Permira, are to issue a long-term bond to refinance £4bn of bank debt, which could lead to a break-up.

Doughty divests Vue to Omers and Alberta for £935m

Doughty Hanson has sold cinema group Vue Entertainment to Omers Private Equity and Alberta Investment Management Corporation (AIMCo) for an enterprise value of ТЃ935m.

BC brings in the banks for Foxtons float

BC Partners has hired Credit Suisse, Numis Securities and Canaccord Genuity to handle the flotation of London estate agency Foxtons.

PAI's Zinsou to retire; succession plans underway

PAI partners' chief executive Lionel Zinsou is to step down in 2015 as the private equity house draws up its succession plans.

Waiting for the direct lenders

Direct lenders

LDC backs Rimor MBO

LDC has supported the management buyout of subsea oil and gas manufacturing and engineering services firm Rimor.

LDC returns to MB Aerospace

Despite exiting MB Aerospace three months ago, LDC, alongside new owner Arlington Capital Partners, has reinvested in the aerospace engineering group to support its acquisition of Delta Industries.

General Catalyst et al. invest $12m in YPlan

General Catalyst Partners has led a $12m series-A funding round into British mobile start-up YPlan alongside existing investors Wellington Partners and Octopus Investments.

CD&R in potential Balfour and Rentokil deal

Clayton Dubilier & Rice is in talks over a potential merging of the office maintenance business of Balfour Beatty and Rentokil Initial.

The changing face of fund manager selection

GP selection

Rutland picks up Equistone's AFI-Uplift

Equistone Partners Europe has offloaded AFI-Uplift to Rutland Partners in a deal that combines three companies for a total enterprise value of around ТЃ85m.

Terra Firma granted EMI retrial

Terra Firma is to undergo a retrial over EMI as the private equity house continues to claim that Citigroup fraudulently forced it to overpay for the music group.

Anson replaces Morelli as EVCA chairman

George Anson, managing director of Harbourvest, is to take over from Vincenzo Morelli as the European Private Equity and Venture Capital Association's (EVCA) latest chairman.

Warburg Pincus and General Atlantic acquire 50% of SAM

Warburg Pincus and General Atlantic have taken a 50% stake in Santander Asset Management for €700m.

UK consumer sector exits at record levels

The number of UK consumer goods assets divested by private equity firms is at its highest level in 10 years despite the continued desolation suffered by the consumer market.

Beringea exits Fjord

Beringea has sold service design consultancy Fjord to management technology outsourcing and consulting service provider Accenture Interactive.

Graphite sells Dominion Gas to Praxair

Graphite Capital has sold Aberdeen-based oil field services company Dominion Gas to NYSE-listed Praxair.

TPG and VTB consider Lenta listing in London

TPG and VTB Capital are in talks with banks concerning a possible London listing of Russian supermarket chain Lenta.

Metastudy: Private equity drives innovation and growth

A new secondary research report has found that private equity investing leads to increased foreign investment and improvements in innovation.

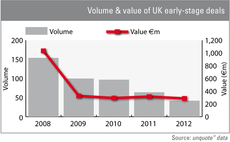

Value of UK early-stage investments holds steady

UK early-stage deal numbers are dropping off, but the total value invested has held steady over the last four years.