Articles by Mikkel Stern-Peltz

Vaaka takes majority stake in Molok

Investment by Finnish buyout house forms part of plan for international expansion

ATP appoints Nordea AM head Hyldahl as new CEO

Head of Nordea Asset Management Christian Hyldahl replaces Carsten Stendevad

Creandum leads $10m series-A for KNL Networks

Existing investors Inventure and Butterfly Ventures re-upped for the funding round

CVC's Ahlsell valued at SEK 20bn in IPO

Plumbing and tools wholesaler prices at bottom of its share price range in Stockholm listing

Vista Equity-backed Misys scraps £3.5bn London IPO

Decision comes a week after company cut the value of its IPO by ТЃ1bn

HealthCap et al. in SEK 327m round for Bonesupport

Round brings the total amount raised by the Swedish biotech company to more than SEK 750m

Altor sells SEK 350m of Dustin shares

Share sell-down comes 18 months after SEK 3.8bn Stockholm IPO

Nordic Capital in take-private bid for Nordnet

GP bid is made in cooperation with majority owner The Уhman Group, which will retain a stake

Maj Invest holds €215m first close on fifth fund

Danish GP has raised 80% of target for fifth vehicle targeting Danish SMEs

Ratos makes loss on SEK 650m Euromaint exit

SEK 650m EV divestment comes after GP divested companyтs German arm in January

Vaaka Partners adds EQT's Koskenvuo

Ville Koskenvuo joins the Finnish buyout firm as a partner from EQT

BC Partners buys 22 Priory Group clinics from Arcadia

GP acquires UK mental health facilities from the US group as part of regulatory compliance

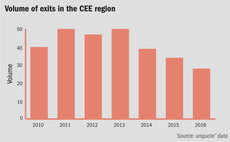

CEE could arrest exit flow decline in 2016

Region is seven exits short of exceeding 2015’s total for PE- and VC-backed exits

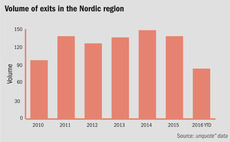

Nordic exits facing slump in 2016

Market needs strong fourth quarter numbers to surpass last yearтs exit volume and avoid a five-year low

Viking Venture takes minority stake in Xait

Nordic VC acquires 43% shareholding in Sandnes-based document production tool developer

CVC's Ahlsell aiming for SEK 23.4bn valuation in IPO

Ahlsell sets price range and aims for first day of trading on 28 October in Stockholm

Private equity's public market problems

Despite strong investor appetite for listed private equity houses, life on the public markets brings with it numerous challenges

Ratos takes SEK 1.7bn hit to portfolio

Norwegian oil services company Aibel sees book value written down by SEK 1.1bn

LP Profile: ATP

Danish pension fund is among Europe’s largest but does not prescribe asset allocation targets

Krokus makes 3.5x on final exit from Polwax

Private equity firm sells final shareholding in Warsaw-listed paraffin producer

General Atlantic backs Joe & The Juice

Incumbent GP Valedo Partners reportedly reaps in excess of 20x on the partial sale

Doughty Hanson makes 2.5x on LM Wind Power exit

GP fully realises 1998-vintage third fund after 15-year holding of Danish company

Industrifonden leads $6m round for Soundtrap

Stockholm and Silicon Valley-based app will use funding to accelerate product development

Livonia Partners buys garden centre Hortes

GP completes second buyout from maiden vehicle with Estonian retail business