Early-stage

P101 leads €1.2m round for Sellf, Waynaut and Wiman

Backers in the round include Tim Ventures and Atlante Seed

LBBW leads €6m series-B for Amcure

Backers include existing investors KfW, MBG and S-Kap Unternehmensbeteiligungs

Atomico signs €10m series-A for Lilium Aviation

Deal saw the GP act as the only investor in the round for the Germany-based business

Union Square and Mosaic join $20m series-B for Clue

Round was led by Finnish corporate venture firm Nokia Growth Partners

Sunstone Capital et al. lead €9m series-B for Dubsmash

GP co-led the round alongside Balderton Capital as well as existing investor Index Ventures

High-Tech Gründerfonds leads €9m series-A for Audiocure

Backers in the round include new shareholder Med-El and several private investors

Life Sciences Partners et al. in €32m round for Oxthera

Round also saw participation from Ysios Capital, Sunstone Capital and Flerie Invest

Digital Space Ventures leads €3m series-A for Cashboard

Existing backers include Redalpine, Earlybird, 500 Startups and several business angels

Target invests €2.2m in ArangoDB

GP currently invests from its second fund, a €113m vehicle

HTGF provides seed funding for Flowtify

Prior to the seed round, the startup took part in the Metro Accelerator in October 2015

HTGF and Bayern Kapital in Mecuris seed round

Mecuris claims to operate in a €1.8bn market for prosthetics in Germany

Credo in £1.3m round for Cera

Funding round will support the launch of the London-based online social care platform

HTGF in Filestage seed round

Germany-based VC High-Tech Gründerfonds usually invests €600,000 at the seed stage

IBB in €4.2m SearchInk round

IBB invested together with former Google engineering director Michael Schmitt

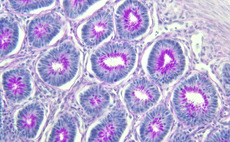

MPM in iOmx Therapeutics' €40m series-A

Proceeds will be used to develop proprietary product candidates

Ysios et al. raise €15.5m series-B for CorWave

Backers include existing shareholders Sofinnova Partners, BPI France and Seventure Partners

Target Partners in €2m Autolabs seed round

Autolabs founder Holger Weiss is also venture partner at Target Partners

Mucap et al. in €10m Promethera series-C extension

Fresh capital will enable biotech company to invest in new product development

White Star, Oxford Capital in $2m Red Sift round

Data analytics software developer will use the funding to invest in product development

Caixa Capital Risc leads €1.5m round for Iproteos

Following the round, the company totals €3m of funding raised since its foundation in 2011

Founders, Vækstfonden back €2m round for Kontist

Fintech company is currently in the development stage and aims to launch its app in 2017

Industrifonden leads $6m round for Soundtrap

Stockholm and Silicon Valley-based app will use funding to accelerate product development

Sunstone et al. raise $6m series-A for Sourced

Backers include venture capital houses Otium Venture and Kima Ventures

Amadeus injects £1.5m into HealX

Funding will enable the drug repurposing company to invest in its proprietary technology