Exits

Omers considers sale of ERM for £2.5bn – report

Omers Private Equity acquired ERM from Charterhouse for an enterprise value of $1.7bn in June 2015

Eurazeo exits Iberchem in €820m deal

Sale generates a cash-on-cash multiple of 2.1x and a 25% IRR for Eurazeo Capital

VC-backed Spacemaker sold to Autodesk for $240m

Deal comes a year and a half after the startup raised a $25m series-A round co-led by Northzone and Atomico in June 2019

Permira hires Goldman Sachs, Morgan Stanley for Dr Martens' IPO – report

Permira acquired the brand in 2013 for ТЃ300m, with debt provided by Barclays

EQT-backed HusCompagniet prices IPO

Company's IPO had reportedly been covered on the first day of the bookbuild

Mutares exits Nexive in €60m deal

Mutares and Dutch mail company Postnl sell the entire share capital of Nexive to Poste Italiane

Bridgepoint-backed Diaverum to launch IPO

Planned IPO could reportedly value at the renal care clinics group at more than тЌ2bn

LDC mandates Rothschild to sell Adey - report

LDC acquired the company in June 2016, using a тЌ60m unitranche provided by Alcentra

Montagu to acquire ISI from Citic

Completion of the sale is expected next month, subject to customary closing requirements

Nordic Capital-backed Nordnet prices IPO

Offer amounts to roughly 38% of the total number of shares being offered in the company

PE-backed Nets and Nexi sign agreement for merger

Deal values the Danish paytech company at тЌ7.8bn

BC to acquire Keesing from Ergon Capital, Mediahuis

Ergon invested through the тЌ350m buyout vehicle Ergon Capital III, which closed in 2010

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

EQT buys majority stake in Thinkproject from TA

TA Associates bought the construction software company in 2016 and has reinvested as part of the SBO

Electra hires Stifel for Hotter Shoes sale

Skelmersdale-based Hotter had revenues of ТЃ89.3m in the year ending on 31 January 2020

Second-round bids due next months for Kotkamills - report

Triton Partners is one of the GPs vying for the company, according to Mergermarket

Altitude exits Mortec Semiconductor for 12.6x return

Altitude acquired the company in July 2016 in a deal that valued the company at around ТЃ1m

MCH sells Lenitudes, invests in Atrys

Sale ends a six-year holding period for MCH, which acquired a 66.5% stake in Lenitudes via its third fund

Auctus buys Landbäckerei Sommer from SIP

SIP acquired the bakery chain in 2011 and has made returns of more than 20x its total investment

Lea Partners sells IDL to PE-backed Insightsoftware

Lea acquired a majority stake in the financial performance enterprise software business in 2019

PAI acquires LDC's Addo Food and Equistone's Winterbotham Darby

Both management teams have reinvested and operations will continue to be run separately

EQT sells Tia Technology to trade

GP is selling the company for $78m in cash on a fully diluted basis, six years after acquiring it

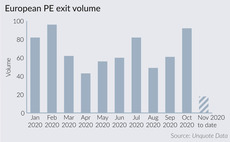

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

LDC sells Babble to Graphite for £90m

LDC retains a minority stake in Babble, while the management team is reinvesting some of its proceeds