Deals

Bencis-backed Prinsen-Buisman buys Gustav Berning

Bencis will become the largest shareholder in the new group, with management taking minority stakes

Cornerstone sells Infoniqa SQL back to management

Deal ends a five-year holding period for Cornerstone, which acquired Infoniqa SQL in 2012

Lexington, BC Partners agree $1bn stapled secondary deal

Lexington was previously reported to be considering acquiring up to тЌ1.2bn in secondary commitments

Bain and Cinven still 17% short on Stada offer

Acceptance period ends at midnight tonight, with no plans for another extension

EQT's IP-Only secures SEK 8.3bn refinancing

Refinancing replaces an existing debt package believed to be worth around SEK 4.3bn

Calculus injects £2.5m into Axol Bioscience

Investment will be used to attract clients and grow the business organically

BGF's Solid Solutions acquires New Technology CadCam

3D design software reseller, backed by BGF since 2016, expands in the UK market

BayBG, Vito Ventures back €1.3m round for VR-On

Vito and entrepreneurs Andreas Perreiter and Carsten Erdt also invested in the round

Rocket Internet et al. sell Glossybox to PE-backed Hut Group

Rocket Internet was the largest shareholder prior to the transaction, followed by Kinnevik

Project A backs $2m funding round for Qunomedical

Paris-based Kima Ventures and US VC firm 500 Startups also participated in the round

Endless backs Sewtec Automation MBO

Endless is currently investing from Endless Fund IV, which closed on ТЃ525m in 2014

Oaktree acquires Vitanas and Pflegen & Wohnen

Care home business has recently invested in modernising and expanding its facilities

Bain, Cinven still short of Stada acceptance threshold

Consortium submitted a new bid at €66.25 per share after its initial €66 offer failed

VC backers sell Savedo to Deposit Solutions

Investors include Finleap, DVH Ventures, German Startups Group, Kreos Capital and XAnge Private Equity

Capiton sells Gess Group to Auctus-backed JR Holding

Ends a seven-year holding period for Capiton, which purchased a 68% stake in September 2010

Core Capital invests in Avonside Group Services

Deal will support the roofing company's acquisition of competitor Bracknell Roofing

DII sells Carus to Getinge

Deal ends a 12-year holding period for the GP, which purchased a majority stake in 2005

CapMan acquires 45% stake in Russia's Medisorb

Deal for the Russian pharmaceutical business is the third investment of CapMan's Russia II fund

Erhvervsinvest buys Denmark-based Bogballe

Transaction marks the first deal for the GP's Erhvervsinvest IV fund

Cinven collects bids for CeramTec

Company, which has been owned by Cinven since 2013, is expected to sell for more than €2bn

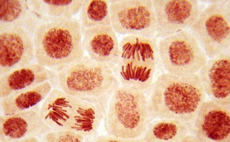

HTGF backs €7m seed round for Zimmer Biotech

Zimmer Biotech will focus on developing a skin cancer drug based on 5-Aminolevulinic acid

Astorg, Montagu partially exit Sebia to CDPQ

Astorg and Montagu acquired the healthcare company from Cinven in 2014

Oak Hill-backed Pulsant bolts on LayerV

Development comes a year after the UK-based IT business bolted on competitor Onyx Group

PE-backed Siblu in amend-and-extend refinancing

As part of the transaction, the company added a €30m note meant to support its growth