Deals

Palamon in SEK 765m SBO of Happy Socks

Transaction includes a growth capital component of SEK 40m

Mid Europa in €202m sale of Hungary-based Invitel to China-CEE Fund

Exit values the telecommunications business at 4.5x its 2015 EBITDA

Connection invests £5.4m in Clamason MBO

Precision metal pressing company will look to capitalise on its Slovakian manufacturing facility post-Brexit

Alpina backs German software developer Gefasoft

GP acquires an undisclosed stake in the business from its 2013-vintage Alpina Partners Fund vehicle

Chequers Capital exits Provalliance

Chequers exits the Paris-based hair salon operator after a four-and-a-half year holding period

BGF invests in Ultra Finishing

Deal marks the GP's second investment in north-of-England-based bathroom suppliers in six months

IK sells dental group Colosseum Smile to Jacobs Holding

GP exits Norway-headquartered dental group after a six-year holding

HenQ leads €5m series-A round for Housing Anywhere

New funding round brings the total amount raised by the Dutch startup to $6.27m

Wise's Biolchim purchases 70% stake in Matécsa

Deal marks the third bolt-on acquisition during Wise's ownership

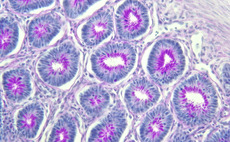

EMBL, Life Sciences Partners lead €8m series-A for Luxendo

GPs completed the funding round launched in 2015 with an additional €2m injection

TA Associates buys Think Project

GP acquired an undisclosed stake from former investor Walter Beteiligungen und Immobilien

Exponent sells Immediate Media to Hubert Burda in £270m deal

Sale of the UK media company values the business at around 7.3x its 2015 EBITDA

Boehringer Ingelheim leads €9m series-A for Heparegenix

Backers to the funding round include Novo Seeds and High-Tech Gründerfonds

Caixa, Kereon lead €2.5m round for Transplant Biomedicals

Deal marks the second round led by the two investors for the Spanish business

Indinvest leads $9.4m series-B for Ngdata

Deal marks the second tranche of the $20m series-B round for the business

MBO Partenaires and Societe Generale exit CFDP

Financière Miro and insurance group Scor take a combined 52% stake in the group

ECI acquires minority stake in Edenhouse

Deal marks the GP's second investment in the tech consultancy segment in the space of six months

Magnum Capital acquires Itasa

GP drew down capital from its second vehicle, Magnum Capital II, to finance the transaction

MML sells Optionis to Sovereign-backed Arkarius

Deal for professional services business is primarily funded by the refinancing of Arkarius's existing debt

Main Capital invests in Artegic

Benelux player Main Capital opened a local office in the DACH region in August

Miura reaps $31m in GH Induction sale

After a four-year holding period, the GP exits the business via a trade sale

LDC's Away Resorts secures refinancing, makes sixth acquisition

Permira provided the new debt facilities which enables the group to buy Sandy Balls

Capital Croissance, BPI back expo business Spas

Socadif, previous majority shareholder in the group, is reducing its stake on this occasion

Victory Park leads iZettle's €60m series-D extension

Swedish payment service had already raised тЌ60m in a series-D in Q3 2015