Deals

Naxicap's House of HR acquires Human Capital Group

Naxicap first took a stake in the recruitment consulting group in 2012

Ratos buys Plantasjen from Apax in NOK 2.9bn deal

Deal sees Apax selling Oslo-based Plantasjen after 10 years at the helm

Capvis buys majority stake in Gotha

Deal marks the third investment in northern Italy for the Baar-based GP

Global Founders in $3m round for FreightHub

Business has been operating since August 2016 and hopes to make 500 shipments this year

Kereon leads €500,000 round for Didáctica

Backers include investment holding Interalios and several private investors

Equistone acquires majority stake in Motoblouz

Investment marks Equistone's third investment in the motorcycle clothing and accessories sector

Vaaka picks up LTP Logistics

Private equity firm Vaaka acquires a majority stake in the Finnish food logistics business

Ardian's Solina acquires New Ivory

GP acquired a majority stake in French ingredients producer Solina in 2015

Syntegra and Index exit Moleskine

Delisting after three years values the equity of Moleskine at €506m

123Venture sells AM Froid to Engie Axima

VC acquired a majority stake in the group in 2012 alongside Calliode partners

Alcedo buys 55% of Italy's Nahrin Swiss Care

Deal marks the second acquisition from the GP’s 2015-vintage Alcedo IV fund

Nets IPO is largest Nordic PE-backed listing for six years

Advent and Bain's company is largest Nordic PE-backed IPO since DKK 41.5bn TDC flotation in 2010

Sabadell VC leads €1m round for Captio

Backers include Venturcap, Bankinter, Telegraph Hill Capital and Kibo Ventures

Horizon et al. invest $28m in FinanceFox

Funding will be used for further expansion and to boost its marketing efforts

SHS invests in spine implants producer EIT

Business hopes to use SHS's investment for an expansion to the US market

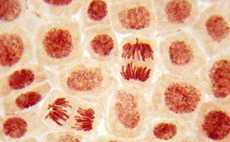

Inveready leads €3.5m round for Leukos Biotech

GP has drawn down capital from its Inveready Innvierte Biotech II vehicle

IK makes final Fund VII investment with I@D buyout

Naxicap Partners invested in the group in 2012 and realises a partial exit through the deal

HarbourVest buys extra €42m commitment in Indigo Capital V

LP almost quadruples commitment to mezzanine debt provider's 2007-vintage vehicle

Calculus nets 1.8x on Metropolitan Safe Deposits exit

GP exits London-based business four years after investing at 6.32 pence per share

Deal in Focus: Kartesia supports ProFagus expansion

Alternative lender bets on its existing network in locating German deals, as it supplies a debt replacement package for Steeadfast-backed ProFagus

Parquest invests in Eres

Transaction marks sixth investment made with Parquest's first fund, which nears full commitment

ArchiMed buys three French biotech businesses

As part of the deal, the GP has bought three French biotech businesses, Fyxteia, HIS and Polyplus

Bregal buys Kunststoff Schwanden

Management buyout sees Bregal Unternehmerkapital acquire a majority stake

Imperial Innovations et al. in £25m series-A for Artios

Investment funds the spinout of the biotech business from Cancer Research UK