Deals

EQT and GIC opt for Springer Science IPO

EQT and GIC's plans for a potential trade sale of German media publisher Springer Science to BC Partners have definitely been scrapped as the owners firmly focus on a listing.

Gimv backs €40m investment in Lampiris

Gimv has jointly invested €40m in Belgian green energy supplier Lampiris with the Regional Investment Company of Wallonia (SRIW).

Bridges sells The Gym Group to Phoenix

Bridges Ventures has sold a majority stake in The Gym Group to Phoenix Equity Partners, realising a 3.7x money multiple and a 50% IRR.

Tar Heel backs Rockfin in first investment from Fund II

Tar Heel Capital has acquired a 60% stake in Rockfin, a Polish supplier of hydraulic and pressure systems.

Greylock Partners et al. invest $15m in Wrapp

Greylock Partners, Atomico, Creandum and other backers have invested $15m in a series-B funding round for mobile gifting service Wrapp.

EQT's Munksjö lists on Nasdaq OMX Helsinki

Shares in EQT-backed speciality paper producer MunksjУЖ have started trading on the Helsinki Stock Exchange.

European Capital exits MTH

European Capital has sold German company Metall Technologie Holding GmbH (MTH) to LOI Thermprocess GmbH, reaping a 1.6x multiple on its original investment.

Ingenious sells Digital Rights to Modern Times for £13.2m

Ingenious Media Active Capital (IMAC), a closed-ended investment company managed by Ingenious Ventures, has sold its stake in Digital Rights Group (DRG) to Swedish broadcaster Modern Times Group (MTG) for ТЃ13.2m.

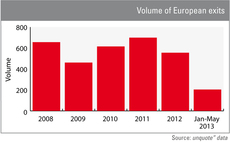

2013 exit activity on course to match quiet 2012

Divestment activity figures so far this year highlight the exit environment remains tough for GPs looking to return cash to investors – although recent weeks have seen positive trends unfolding.

Sentica's atBusiness merges with Innofactor

Sentica Partners Oy has sold Finnish technology company atBusiness to Innofactor.

HG International trades hands between Gilde funds

Gilde Equity Management Benelux (GEM) has sold Dutch cleaning products supplier HG International BV to the GP's sister division, Gilde Buyout Partners (GBP).

Uniqa to sell $665m private equity portfolio

Austrian insurance company Uniqa Versicherungen is planning to offload $665m of private equity positions ahead of Solvency II.

EQT's Springer Science still in dual-track process

BC Partners is reportedly left as the sole bidder for EQT portfolio company Springer Science, which announced IPO plans last week.

LBO France to team up with Fosun for Nocibé bid

French firm LBO France could make a joint bid with Chinese conglomerate Fosun for Nocibé, the French perfume and cosmetics retailer owned by Charterhouse, according to reports in the local press.

Herkules picks up Umoe Schat-Harding and Noreq

Herkules Private Equity has acquired life-saving equipment companies Umoe Schat-Harding and Noreq in a combined transaction.

North West Fund backs Fourteen IP

The North West Fund for Venture Capital, managed by Enterprise Ventures, has committed ТЃ500,000 to communications solutions firm Fourteen IP.

Northzone et al. exit Energy Micro to Silicon Labs for $170m

Northzone and Investinor have exited Norwegian company Energy Micro AS to Nasdaq-listed Silicon Labs for $170m, reaping a 2.5x multiple on their original investments.

Mobeus reaps 2x on BIH exit

Mobeus Equity Partners has divested the main operating facility of British International Helicopter Services (BIH) to trade player Patriot Aerospace Group, realising a 2x return.

PDV Inter-Media Venture et al. back PressMatrix

PDV Inter-Media Venture has joined existing backers in a €2.5m series-A funding round for PressMatrix, a German technical service provider for tablets and mobile devices.

Deutsche Annington to list ahead of Terra Firma fundraise

Deutsche Annington, the German real estate group backed by Terra Firma, has confirmed it will list on the Frankfurt Stock Exchange this year.

MML-backed Arena makes Asian bolt-on

MML Capital-backed Arena has acquired Malaysia-based Asia Tent International.

Apax to lead GFI Informatique takeover

Apax France and listed fund Altamir Amboise have announced plans to lead a takeover offer for French listed IT business GFI Informatique.

NVM achieves 3.3x on IG exit

NVM Private Equity has sold IG Doors to the HУЖrmann Group, generating an IRR of 17.3% and a 3.3x money multiple.

VC-backed Valkee raises €7.4m

Finnish health technology company Valkee has announced a тЌ7.4m series-A funding round.