Deals

Carlyle-backed Applus buys EDI

Testing firm Applus, backed by Carlyle and Investindustrial, has bought Chinese engineering firm EDI.

IMI.VC backs Game Insight with $25m

Russian investor IMI.VC has invested $25m in Moscow-based mobile gaming network Game Insight, valuing the company at $550m.

Oraxys in €21m round for Leosphere

Cleantech investor Oraxys has injected €10.5m into French laser measurement company Leosphere in what constitutes the first tranche of a €21m funding round.

MMC and Enterprise Ventures back Tyres on the Drive

MMC Ventures and Enterprise Ventures have provided ТЃ640,000 of follow-on funding for Tyres on the Drive.

Olympia Furniture enters administration

SKG Capital-owned furniture manufacturer Olympia Furniture, based in the Greater Manchester area, has failed to find a buyer and has therefore been placed into administration.

Ace and IRDI inject €4.5m into ARM

Ace Management and investment company IRDI have provided French spare parts manufacturer Groupe ARM with €4.5m of growth capital funding.

Albion backs healthcare software firm MyMeds&Me

Albion Ventures has invested ТЃ2m in British healthcare software-as-a-service (SaaS) business MyMeds&Me.

Union Square leads $30.6m round for Hailo

UK-based taxi network service Hailo has raised $30.6m from existing and new investors.

Finance Wales continues support of KWR

Regional investor Finance Wales has injected ТЃ250,000 into software firm KWR Technologies Ltd (KWR).

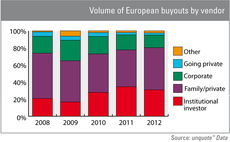

SBOs subside in 2012

Following a record 2011, the volume of “pass-the-parcel” deals abated slightly last year – but primary transactions still have a long way to go before returning to their pre-crisis glory.

Apax and LBO France to sell Maisons du Monde

Apax France- and LBO France-owned furniture stores chain Maisons du Monde is up for sale in a process run by investment banks Lazard and Messier Maris, according to reports.

PHD Equity completes MBO

PHD Equity Partners, the private equity arm of Dow Schofield Watts, has backed the management buyout of lending company Davenham Group.

123Venture injects $3.3m into Logix Aero

123Venture has provided Logix Aero, a French provider of spare parts management solutions to the aerospace industry, with $3.3m of growth capital.

HTGF and VersoVentures back Cumulocity

High-Tech Gründerfonds (HTGF) and VersoVentures have backed Nokia Siemens Networks (NSN) spin-off Cumulocity, a German software developer.

Electra Partners to buy UBM data division for £160m

Electra Partners is set to acquire information services provider UBM Data Services in a ТЃ160m spin-off from parent company UBM.

International interest picks up in Central & Eastern Europe

European private equity was abuzz with exits paving the way for fundraisings last year, and CEE was no exception. Kimberly Romaine reports

Cofides supports Agrovin with €3m

Cofides has injected €3m into Agrovin, a Spanish manufacturer and distributor of wine products.

Verdane acquires Nordic Venture Partners I portfolio

Verdane Capital has wholly acquired the LP interests of Nordic Venture Partners I through its Verdane Capital VII fund.

BGF backs Bullitt with £3.5m

The Business Growth Fund (BGF) has injected ТЃ3.5m into Bullitt Group, a UK-based service provider to the telecommunications industry.

HTGF et al. back Sopat

High-Tech Gründerfonds (HTGF) and Steelhouse Ventures Ltd have invested in a first round of funding for Berlin-based Sopat, a digital image analysis business.

Palatine invests in Chase Templeton

Palatine Private Equity has invested in British private medical insurance broker Chase Templeton.

Project A Ventures backs Glow

Project A Ventures and Avonmore Developments have backed Glow Digital Media, a London-based provider of Facebook ad technology solutions, with $1.3m of funding.

Via Venture Partners acquires UVdata

Via Venture Partners has, together with several key employees, acquired a majority stake in Danish IT company UVdata AS.

N+1 buys Probos from Explorer

N+1 Private Equity has acquired Portuguese plastic band manufacturer Probos in a €75m SBO from Explorer.