Deals

Fondo Strategico backs Kedrion Biopharma

State-backed Fondo Strategico Italiano has invested €150m in Italian biopharmaceuticals company Kedrion Biopharma in exchange for an 18.7% stake.

Fondo Strategico backs Metroweb

Italian state-backed investor Fondo Strategico Italiano has made its maiden investment, injecting €200m into Milan-based fibre optics company Metroweb in exchange for a 46.2% stake.

Target Partners invests in adeven

Munich-based venture capital firm Target Partners has invested between €1-10m in a series-A funding round for mobile advertising analyst adeven.

France: acquisition finance off to good start in 2012

The overall value of French PE-backed acquisition finance deals completed in the first months of this year has already exceeded 2011 year-end figures. Recent research also highlights that French businesses remain hungry for build-up opportunities.

Priveq backs MBO of Office Management

Priveq Partners has taken a majority stake in Swedish office supplier Office Management.

HTGF invests in AudioCure Pharma

High-Tech Gründerfonds (HTGF) and business angel Dr Schumacher have provided German drugs candidate developer AudioCure Pharma with seed funding.

Comecer acquires Brita Trade

Fondo Italiano portfolio company Comecer has acquired Brita Trade, a Czech glass processing firm.

Sator backs Extrabanca

Sator private equity has made an initial €15m investment in independent bank Extrabanca, securing a 38.9% stake.

Seventure injects €2m into Netino

Seventure Partners has invested €2m in French online content moderation platform Netino.

Sentica acquires Silta

Sentica Partners has taken a majority stake in payroll consultancy Silta.

Finance Wales backs QPC with £2.3m

Finance Wales has invested ТЃ2.3m in Welsh information technology company QPC.

Inveready leads €1.5m round for Wineissocial

Inveready has led a series-A funding round of more than €1.5m for Spanish wine e-tail and recommendation site Wineissocial.

Moody's forecasts €33bn+ LBO default

More than a quarter of unrated private equity LBO debt will default by 2015, according to ratings agency Moody’s.

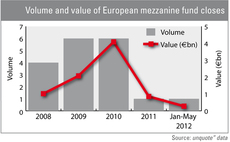

Are mezzanine funds making a comeback?

The launch of 123 Venture’s latest mezzanine fund, the €100m Trocadero Capital Transmission II, is the second mezz fund launch this year with CIC Mezzanine III. In parallel, the number of mezzanine funds reaching final close has declined from 6 in 2010...

Idinvest et al. back Sensee with €17.5m

Idinvest Partners, Partech International, Orkos Capital and several business angels have provided French online optician Sensee with a €17.5m funding round.

Fondations Capital grabs 60% of Sepur

Fondations Capital has acquired a 60% stake in French waste collector Sepur from its founder, in a deal that values the business at €124m.

Bain Capital sells FCI division for €765m

Bain Capital Europe has sold the motorised vehicles division of FCI, an automotive and electronics connector company, to NYSE-listed Delphi for €765m on a cash and debt-free basis.

De Persgroep Netherlands acquires 80% of PE-backed VNU Media

The Dutch arm of Belgian media company De Persgroep has acquired an 80% stake in Netherlands-based VNU Media, which is jointly held by 3i and HIG Capital.

European secondaries boom unlikely to end soon

Secondaries boom unlikely to end soon

Viking Venture exits myVR

Viking Venture has exited Norwegian software company myVR to Swedish trade player Hexagon.

Rutland Partners' Notemachine completes £63m refinancing

GE Capital, Barclays and European Capital have provided a ТЃ63m senior debt refinancing package for Rutland Partners' UK portfolio company Notemachine.

Advent exits Vitrue to Oracle

Advent Venture Partners has exited US portfolio company Vitrue in a trade sale to IT solutions developer Oracle, following a 15-month holding period.

Equistone in €1bn Global Blue exit

Equistone Partners Europe (formerly Barclays Private Equity) has sold travel payment service provider Global Blue to Silver Lake Partners and Partners Group in a €1bn deal.

Nordic Capital acquires Tokmanni from CapMan

Nordic Capital has acquired Finnish discount retailer Tokmanni Group from CapMan.