Deals

Main Capital sells Actuera to Waterland Private Equity

Main Capital has sold its majority stake in Dutch business software developer Actuera to Waterland Private Equity.

Altor buys Haarslev Industries from Odin Equity

Altor Equity Partners has acquired a majority stake in cleantech equipment producer Haarslev Industries from Odin Equity.

Reiten's StormGeo acquires Met Consultancy

Reiten & Co-backed StormGeo has acquired Dubai-based weather forecasting company Met Consultancy.

BayBG invests in Prevero

BayBG has backed software company Prevero with a mezzanine structure in the form of a silent partnership.

KBC exits Dynaco

KBC Private Equity has sold door-manufacturer Dynaco to Assa Abloy in a deal valued at €75-125m.

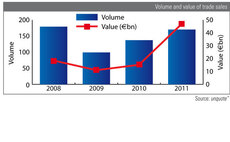

Trade sale values boom in 2011

Trade sales continue to be the most common exit route in 2011 and increased by almost €30bn in value, while secondary buyouts are stalling, reflecting the tough economic conditions of the past year. Anneken Tappe reports

BayBG invests in Rosner Fashion

BayBG has taken a 43.5% stake in clothing retailer Rosner Fashion as part of a capital increase.

Altima and Finance Wales back Acuitas with €1m+

Welsh medical company Acuitas Medical Limited has secured a funding round of just more than тЌ1m from private and institutional investors including Altima Partners and Finance Wales. According to Acuitas, the funding round was oversubscribed.

Entrepreneur Venture injects €1m in TBS Group

French growth capital investor Entrepreneur Venture has injected €1m into marketing software developer TBS Group.

Primary Capital rescues Hawkin's Bazaar

Primary Capital has backed the management of Hawkinтs Bazaar to bring the firm out of administration.

2011 exits: trade sales almost triple in value

As the graph shows, the proportion of trade sales, the most common exit route, has not changed significantly between 2010 and 2011.

FSI Régions backs MBI of EBH from RJD

FSI RУЉgions, previously known as Avenir Entreprise, has backed an MBI of European Boating Holidays (EBH) from RJD Partners.

Sun European Partners buys Bonmarché Stores

Sun European Partners has acquired UK clothing retailer BonmarchУЉ Stores.

ISIS backs £46m Autologic MBO

ISIS Equity Partners has invested in the ТЃ46m MBO of UK-based automotive diagnostic software business Autologic.

Ade Gestion exits Jamones Burgaleses

Ade Gestion Sodical has exited processed meats producer Jamones Burgaleses, selling its 20% stake to Campofrio Food Group (CFG).

La Caixa backs vLex

La Caixa has led a €4m investment in online legal research platform vLex alongside reinvestment from shareholders, public money from the Spanish government’s Plan Avanza initiative and the European Network and Information Security Agency. La Caixa invested...

Axis invests in Industrias Hidráulicas Pardo

Axis Participaciones Empresariales has invested an undisclosed amount in hospital equipment manufacturer Industrias Hidráulicas Pardo, part of the Grupo HCS and a portfolio company of MCH Private Equity.

Reiten-backed NEAS divests consulting business

Reiten & Co listed portfolio company NEAS has divested its consulting engineering business to trade player Sweco Norway.

Graphite backs MBO of National Fostering Agency

Graphite Capital has acquired childcare service National Fostering Agency (NFA) from Sovereign Capital in a deal reported to be worth around ТЃ130m.

Gestión de Capital Riesgo backs Kondia Me Taldea

Gestión de Capital Riesgo del País Vasco (GCRPV), the venture arm of the Basque Country government, has injected €750,000 into machine tools manufacturer Kondia Me Taldea in exchange for a 22.5% stake.

Baring exits Centro Inmunológico de Cataluna

Baring Private Equity Partners has completed the exit of medical diagnostics company Centro Inmunológico de Cataluna (CIC) through a trade sale to French medical diagnostics company Labco.

EQT exits Lundhags

EQT has exited outdoor clothing company Lundhags to Norwegian trade player Swix.

TowerBrook buys Volution off AAC Capital

TowerBrook Capital Partners has acquired UK-based ventilation products specialist Volution Group from AAC Capital - a deal reported to be worth around ТЃ160m.

Sovereign Capital-backed IMS merges with HedgeOp

Sovereign Capital's The IMS Consulting Group has merged with software provider HedgeOp.