Deals

General Atlantic takes minority stake in FNZ

Growth equity provider General Atlantic has acquired a minority stake in HIG portfolio company FNZ, a London-based investment services firm.

BGF backs GCI Telecom

The Business Growth Fund (BGF) has invested ТЃ10m in Midlands-based telecoms and data service provider GCI Telecom in return for a minority stake.

Verdane buys EasyPark

Verdane Capital Partners has acquired a majority stake in pay-by-phone parking provider EasyPark.

High-Tech Gründerfonds backs OakLabs

High-Tech Gründerfonds has invested in German biotech company Oaklabs.

Accel leads $1.5m deal for online payment platform GoCardless

Accel Partners, Passion Capital and YCombinator have injected $1.5m (тЌ1.13m) into British online payment platform GoCardless.

Newfund supports Izeos

Newfund has made a growth equity investment in Izeos, a French company offering a range of online services to medical professionals.

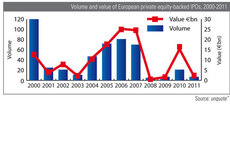

Private equity-backed IPOs, 2000-2011

In appreciation of Facebook's massive IPO last week, unquote" data shows the volume and value of private equity-backed IPOs from the dot-com bubble through the financial crisis of 08/09, up to last year.

Foresight reaps 2x multiple on exit from Factory Media

Foresight Group has sold its majority stake in London-based action sports media publisher Factory Media to Forward Internet Group (FIG), reaping a money multiple of more than 2x.

Lion Capital to carve Findus Nordic operations

Lion Capital is in talks to sell part of UK frozen food manufacturer Findus, according to reports.

Duke Street acquires stake in Parabis for €164.4m

Duke Street has invested in British legal management and claims services company Parabis Group.

DST Global invests in German online retailer

DST Global has bought a 4%-stake in German online fashion retailer Zalando.

The North West Fund backs B2B development consultancy

The North West Fund has announced its investment in B2B IT consultancy Channel Intellect.

LDC supports Pertemps Network Group MBO

LDC has backed a management buyout merging UK-based recruitment services providers Pertemps and Network Group.

EI backs wind energy newco

Enterprise Investors has invested €40m in Polish wind farm newco Wento.

Mid Europa and France Telecom-Orange sell Orange Austria for €1.3bn

Mid Europa Partners and France Telecom-Orange have agreed to sell their combined 100% share in Orange Austria to Hutchison 3G Austria for €1.3bn.

Fidelity Growth leads $11m funding round for Stylistpick

Fidelity Growth Partners Europe has joined existing investors Accel Partners and Index Ventures in an $11m series-B funding round in London-based online fashion service Stylistpick.

Trident Capital leads $8m investment round for AlienVault

Trident Capital has led an $8m series-B investment round for Spanish security information and event management service provider AlienVault. Coinvestment was provided by previous investors in the company Adara Venture Partners and Neotec Capital Riesgo....

Afinum's Caseking buys Overclockers

Afinum portfolio company Caseking has acquired UK-based ecommerce business Overclockers UK.

Innovacom et al. in $12m Videoplaza round

Innovacom and Qualcomm Ventures have joined existing investors in a $12m series-B funding round for Videoplaza, a UK-based company developing ad-serving technology for managing and monetising online video content.

Consortium of investors injects $5.5m into TeraView

A consortium of EU, US and Asian-based investors that includes YFM Equity Partners and Turquoise International has invested $5.5m in UK-based Terahertz systems and solutions provider TeraView.

Darwin backs MBO of A&A Group

Darwin Private Equity has backed an MBO of insurance broker the A&A Group.

HTGF et al. invest in Conceptboard

High-Tech Gründerfonds and Seedfonds Baden-Württemberg have provided funding for cloud software provider Conceptboard.

Rutland in €180m Attends Healthcare exit

Rutland Partners has sold UK-based healthcare product manufacturer Attends Healthcare (formerly known as PaperPak) to Domtar Corporation for тЌ180m.

Advent Life Sciences leads series-A for CN Creative

Advent Life Sciences has injected ТЃ2m of series-A funding into British healthcare equipment developer CN Creative.