Deals

Investindustrial to take control of Guala

Investindustrial plans to launch a full takeover offer for Guala, at €8.20 per share

ArchiMed's Bomi bolts on Florence Shipping

Third add-on inked by Bomi, following its acquisition of Logifarma and its purchase of ILS

Rundit raises €1m in seed funding

Startup was founded this year and has so far raised тЌ1.6m in total

Investcorp sells Avira, nets 200% IRR

Cybersecurity company saw EBITDA increase by 80% during the eight-month investment period

EQT acquires 30% stake in listed company Beijer Ref

GP buys $1.1bn stake from air conditioner manufacturer Carrier Global Corporation

VCs in CHF 20m funding round for H55

New investor Tippet Venture Partners leads the round alongside existing investor ND Capital

Korona Invest acquires stake in Enmac

Enmac is GP's sixth investment from the fund, which was 50% deployed following its fifth investment in April 2020

Sun Capital et al. in £13m round for Roxi

Other investors in the funding round include Terra Firma founder Guy Hands and other angel investors

EQT sells Apleona to PAI for €1.6bn

Deal is PAI's first in the DACH region since appointing Ralph Heuwing as partner and head of DACH

Marcol-backed HealthHero acquires Eight Roads-backed Doctorlink

Doctorlink generated ТЃ3.8m in turnover and EBITDA of -ТЃ7.6m in the year ending on 30 June 2020

EQT Ventures leads €50m series-B for Luko

Company intends to use the fresh capital to further boost its product development and scale up its team

Permira leads €150m round for Catawiki

Accel also backs the round for the Netherlands-based online auction platform

Bain's Fedrigoni buys Industrial Papelera Venus

This is the third add-on inked by Fedrigoni, following its acquisition of Cordenons and its purchase of Ritrama

GP Bullhound leads €3m series-A for Elias Software

Company will use the proceeds to fuel product development and international expansion

Nazca exits Moldcom to Cranemere's ES Group

This is the first divestment made by Nazca IV, a €275m vehicle raised by the GP in 2016

Hg-backed IT Relation bolts on Improsec

With the latest acquisition, IT Relation will add cybersecurity as its fourth business area, alongside cloud services, business consultancy and professional services

Mutares-backed Balcke-Dürr sells Rothemühle to trade

Industrial energy efficiency equipment producer sold its Poland-based operations in April 2020

Horizon's Timico buys Arcus Cloud Services

Horizon bought a majority stake in Timico in 2016 via a deal valuing the company at more than ТЃ50m

Swisscom leads CHF 20m series-A for Anybotics

Equity Pitcher and Ace & Company are also investing in the autonomous industrial robot developer

Sovereign Capital backs Zenitech

Sovereign backs Zenitech founders Christopher Lacy-Hulbert, Edward Batrouni and Csaba Suket

Vidici Ventures et al. in €2m seed round for ReceiptHero

Startup will use the proceeds for further product development, and to expand into Sweden and the Baltic region next year

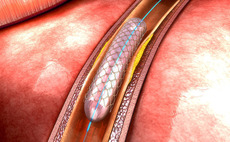

Gyrus buys LivaNova heart valve business for €60m

Gyrus has also made an offer for the heart valve's French division, but a decision remains to be made

GED buys four health services

GP deploys capital from GED VI España, which was launched with a €175m target and held a €100m first close in 2019

Alfvén & Didrikson leads $12m round for Klevu

Retail search engine startup has raised тЌ15m since being founded in 2013