Fundraising

Long-term vision: pros and cons of long-lifespan funds

A panel of LPs, managers and advisers delved into the controversial issue at Unquote's recent Allocate conference

Impact investing gains traction in Spain

Despite representing a very young niche within the country's PE landscape, impact investment is picking up steam and attracting local LPs

Style and substance: The growth of private equity in Italy

Latest edition of Gatti Pavesi Bianchi's new series on the M&A and private equity markets explores why the Italian PE scene is hitting new heights

UK Fundraising Report: Weathering the Brexit storm

Latest Unquote UK Fundraising report, published in association with Aztec Group, is now available to download

Institutional investors eye search fund model

Search funds find attractive small companies and guide their managing entrepreneurs in the development of their business

Tikehau Capital launches €800-875m capital increase

Market cap of French asset management Tikehau Capital stands at €2.183bn as of 17 June

Sector specialisation taking hold in Europe

European private equity firms are sharpening their investment focus by restricting the number of sectors they target

First-time challenges in southern Europe

First-time funds may still be facing a tough road in southern Europe, but GPs are getting increasingly skilled at selling a compelling story

Baltic GPs move upmarket

Combined volume of funds currently raising capital in the region is more than double the entire capital raised since 2012

Unquote Private Equity Podcast: Sector selectors

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses sector specialisation strategies

Impact investment demand outstripping supply – research

LP demand is high but met with a lack of high-quality offerings, according to a Rede survey

Global LPs boost French mid-market fundraising

Country's macroeconomic outlook has played a vital role in boosting investor confidence in France since 2016

BBB to allocate a further £200m to UK venture

Government-backed fund will make commitments to support venture and growth capital via BPC and BBI

Fundraising on track to surpass 2018's dip

So far in 2019, 29 buyout funds have raised nearly тЌ24bn т already 43% of 2018's aggregate amount

Unquote Private Equity Podcast: Sotheby's to PEbay

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses the evolution in the secondary market

Blockchain heralds crypto's second coming

Following the launch of the first securitised token offering to retail investors in the UK, Unquote explores the potential for future VC involvement

Trajan Capital inks first deal prior to fundraise

French GP Trajan specialises in the financing and managerial transmission of French SMEs

Unquote Private Equity Podcast: Training a PE heavyweight

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team looks at what it takes to bulk up a brand ahead of fundraising

Annual Buyout Review: aggregate value reaches new peak

Unquote's lastest Annual Buyout Review, offering in-depth statistical analysis of European buyout activity in 2018, is now available to download

PE to continue enjoying strong tailwinds, says Carlyle's Rubenstein

Speaking at the Invest Europe Investors' Forum in Geneva yesterday, Rubenstein said he does not foresee PE's current run of form ending soon

Bifurcation in European fundraising: beat the traffic

Recent years have seen the growing polarisation of fundraising fortunes for GPs, with established managers able to raise faster than their peers

Q&A: JCRA's Benoit de Bénazé

Some GPs are combatting risks arising from turbulent politics and economic uncertainty by making more frequent use of currency and risk hedging instruments

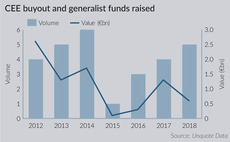

CEE fundraising activity promises buyout revival

Fundraising in the region held strong in 2018 in contrast to the rest of Europe and promises to be even stronger in 2019, even as dealflow slumped

Unquote Private Equity Podcast: Dual speed ahead

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team navigates the bifurcation in private equity fundraising