Fundraising

US investors eye European first-time funds

Maiden fundraises are maintaining momentum, with US institutional investors increasingly drawn to such vehicles

Video: EIF's Panier talks fundraising, succession

Denise Ko Genovese interviews EIF's head of European lower-mid-market equity investments at the IPEM conference in Cannes

Unquote Private Equity Podcast: Minority report

Listen to the latest episode of the Unquote Private Equity Podcast, in which our Precogs envision PE's future of non-controlling stakes

Video: Catching up with Flexstone's David Arcauz

Managing partner David Arcauz talks to Denise Ko Genovese about challenges in the next round of fundraising

Video: Campbell Lutyens' Bajnai talks fundraising, secondaries

Global advisory board chair Gordon Bajnai discusses LP appetite for European opportunities and the inexorable rise of GP-led processes

Unquote Private Equity Podcast: High-water marks and PE larks

Listen to the latest episode of the Unquote Private Equity Podcast, wherein the team discusses the 2019 Annual Buyout Review, Nordic PE's record year and more

Benelux venture fundraising outpaces buyout counterpart

Last year’s €887m committed to venture funds is the second highest ever seen in the region, after 2016’s record of €1.03bn

Indigo holds first close on €170m

Indigo Capital II is targetting €350m and is expected to hold a final close in Q3 2019

Unquote Private Equity Podcast: From Brexit fears to record years

Listen to the very first edition of the Unquote Private Equity Podcast, where the team discusses 2018's hot topics across European PE

European PE in 2019: Paying a premium

Leading industry practitioners discuss private equity developments throughout 2018 and analyse emerging trends for the year ahead

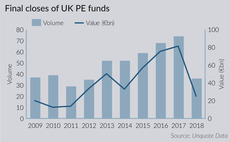

UK Fundraising Report 2018

Latest edition of the UK Fundraising Report is now available to download for Unquote subscribers

Weinberg CP launches impact fund

WCP Impact Dév expects to hold a first close in 2019 and will inject €5-20m in businesses

Brexit puts the brakes on UK fundraising

Country records its sharpest decline since the turn of the century in 2018, with anxiety around Brexit chief among investors' concerns

Mega-funds ignite Nordic nations

Region's PE fund managers raised the highest annual aggregate commitments on record in the first three quarters of the year alone

Nordic Fundraising Report 2018

Nordic private equity funds have raised a record amount of money for a calendar year

Q&A: Forbion Capital Partners' Sander Slootweg

Managing partner at the life-sciences-focused VC speaks to Unquote about fundraising, pursuing a 'build' strategy and the European market

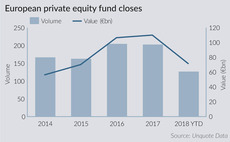

European fundraising cools down after bumper 2017

Number of fund closes by European PE firms and their aggregate commitments have slowed down during 2018, following two years of relentless activity

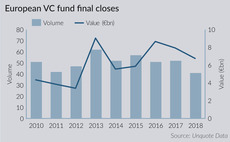

European VC fundraising continues strong showing

VC fundraising totals over 2016-2017 marked a healthy increase of nearly 50% on the amounts raised in the previous two-year period

CEE fundraising landscape in flux

Despite strong activity in 2017, the fundraising landscape means smaller fund managers are struggling to reach their targets

Impact investing: making a splash

As high-profile GPs launch impact-dedicated funds, progress is being made in efforts to identify metrics by which to measure performance in the space

French PE market in rude health

French VCs and GPs invested €6.1bn in startups, SMEs and mid-market firms in H1 2017

GP demand remains strong for Luxembourg's RAIFs

Launched two years ago, the fund structure has been well received by the PE community as almost 500 such vehicles have registered in two years

Push for breakthrough in French renewables

PE players are increasing their focus on the country's renewable energy sector, despite the high profile challenges faced in the space

Tail-end funds fuelling secondaries boom

Recent research shows the proportion of tail-end funds in secondaries transactions has been climbing rapidly, reaching a new record in H1 2018