Fundraising

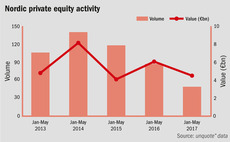

Nordic fundraising market remains buoyant despite dealflow dip

In the first part of our 2017 Nordic Fundraising Report, unquote" examines statistics for the local market across 2013-2017

Nordic Fundraising Report 2017

The 2017 edition of the unquote" Nordic Fundraising Report delves into detailed statistics of local fundraising and investment trends

Nordic Fundraising Report: digging down into the data

unquote" examines the macroeconomics, maturity and strong local LP base the region has to offer

Nordic Capital back on trail with Fund IX

Minnesota State Board of Investment could commit up to $150m to the Nordic GP's new vehicle

Eaton launches direct investment team

Placement agent will work alongside GPs and management to raise capital for investments of $50m and above

Cairngorm closes second fund on £107.5m hard-cap

GP's maiden vehicle has also received a 40% increase in committed capital, bringing it to ТЃ73.5m

Luxembourg becoming a hub for German funds

GPs are increasingly chosing to domicile funds outside of Germany as fundraising in the country gathers pace

Contrasting fundraising fortunes in French mid-market

Numerous closes in Q1 and more on the horizon will give a clearer view of the French fundraising landscape

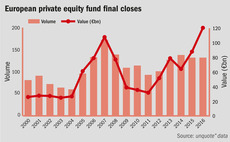

European fundraising surpasses pre-crisis high

Funds investing in Europe raised €120bn in 2016, up 37% on the year before

EQT to onshore all funds in Luxembourg, ditch UK post-Brexit

Brexit-driven uncertainty has ruled out the UK as a future jurisdiction for EQT funds, COO Casper Callerström tells unquote"

Placement agents: Adapt to succeed

Evolving fundraising landscape means placement agents are having to reinvent themselves to future-proof their offerings

Bridgepoint looking to raise further capital for Special Opportunities strategy

The capital pool would be deployed in France-based SMEs in challenging financial situations

How many more generalists can the Nordic PE market bear?

Competition for capital and assets in the Nordic region has skyrocketed to the point of possible oversaturation

Nordic onshoring remains elusive without political assurances

Tax transparency in the Nordic region will only improve slowly without political assurances

Luxembourg the post-Brexit "jurisdiction of choice"

Country's RAIF structures, coupled with Britain's "wait and see" status, are luring more funds to Luxembourg

DACH GPs hunt for value following fundraising bonanza

With strong fundraising activity in the region, GPs must now find value in a challenging market

Building bridges between France and Africa

New BPI France and AfricInvest fund could incentivise French funds to increase investments on the African continent

MCI launches debt fund with $500m target

Debt vehicle structured as evergreen fund supplying diverse financing products to CEE companies

Fund in Focus: Citizen closes second fund on €43m

Final close comes after two years on the road for the GP's second venture vehicle

PE's balancing act: LP appetite remains strong despite challenges

Part two of our Q&A session with PE experts from across the market with discussion centring on fundraising, co-investment and Brexit

From turmoil come treasures: Mapping out PE's road ahead

A panel of private equity experts from across the market discuss developments from 2016 and the outlook for the year ahead

unquote" data snapshot: largest buyout fundraises of 2016

Though the number of €1bn+ funds to hold final closes fell in 2016, a number of large-cap players remained active on the fundraising front

Southern European activity fails to replicate 2015 surge

Italian private equity continues to dominate southern Europe, though the Iberian peninsula continues its recovery

In Profile: TDR Capital

GP launches its fourth vehicle, having successfully raised its annex fund earlier in 2016