Fundraising

European PE in 2017: fundraising tailwinds and growing leverage

Industry professionals look back on a resilient year for private equity during a period of turbulent geopolitics

Fundraising record rounds off active year for Nordic region

Region saw strong fundraising and high deal volume off the back of low interest rates in 2017

Tech gains traction in French private equity

Expansion deals and small-cap buyouts fuelled a strong 2017, with tech proving increasingly popular among buyout houses

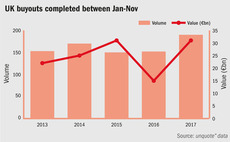

UK buyout activity reaches post-crisis peak in 2017

Small-cap and lower-mid-market invested strongly during the course of the year, while fundraising activity continued apace

Benelux funds specialise to compete with strategic buyers

Record level of commitments were secured by Benelux funds during 2017, with GPs increasingly turning to sector specialisation

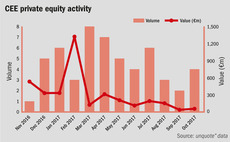

CEE closes out 2017 with strong investor confidence

Fundraising and deal activity both increased in the region during 2017

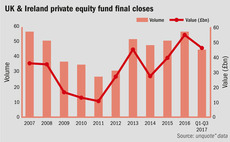

UK fundraising continues apace in 2017

Final closes in the first three quarters of the year show the UK is on track to surpass the post-crisis fundraising peak set in 2016

ICOs and venture capital: friends or foes?

With Asgard becoming the first European VC to hold a coin offering for its new fund, ICOs might present opportunities for institutional fund managers

BC Partners to close 10th buyout fund in coming weeks

GP is understood to be anticipating a handful of commitments before holding a final close in January

GP commitments: are pension pots a viable option?

Pension pots can help private equity professionals get 'skin in the game', says Apollo Private Wealth managing partner Nauman Gondal

UK & Ireland Fundraising Report 2017

Proprietary statistics on the local fundraising market and insights from leading practitioners and LPs

Debut funds flourish in UK market

First-time fundraisings are increasingly frequent in the UK, with 2017 seeing the most final closes of maiden funds for five years

Spain sails with fundraising tailwind

Increased appetite from LPs reflects a continually improving macroeconomic picture in Spain, despite signs that the recovery is slowing

Entrepreneurial spirit helps French VC fundraising rebound

Venture fundraising reaches 2016 levels with two months left of the year, with early-stage and expansion dealflow also on the up

Korelya to manage extra €100m on behalf of Naver

Venture player Korelya is headed by former French secretary of state Fleur Pellerin

Picking a DACH mid-cap master

With so many proponents of the mid-cap space in the region, how do LPs decide on their allocations?

DACH Fundraising Report 2017

Private equity fundraising in the DACH region, as in the rest of Europe, is seeing continued strength

Essling to shake up funds-of-funds formula with new vehicle

Massena spinout Essling this month recruited the funds-of-funds team from Amundi and will launch its first vehicle shortly

H1 fundraising reaches second-highest level on record

Last three semesters represent a significant increase on the total sums raised for final closes, compared with historical levels

UK venture awaits EIF replacement

New national investment fund will look to address shortfall in UK venture space and fill the void left by EIF's post-Brexit approach

Fundraising – North America weekly edition

A roundup of the latest fundraises in North American PE, courtesy of unquote" sister publication Mergermarket

Lexington, BC Partners agree $1bn stapled secondary deal

Lexington was previously reported to be considering acquiring up to тЌ1.2bn in secondary commitments

PAI Partners mulls €4bn fund launch by year-end

GP plans a quick return to the fundraising trail, following a busy 24 months in the wake of its previous close

Stapled secondaries moving upmarket

BC becomes the latest firm to benefit from a stapled secondaries deal, as some industry insiders anticipate a developing trend