Investments

2021 Preview: UK activity on the up, but market braces for tax hit

UK market players are finding solace in investment volumes pulling back towards pre-Covid-19 levels

MLL auction process begins – report

Munich Leukemia Laboratory could generate a valuation of 11-12x, Mergermarket reports

Investindustrial's SPAC trades on NYSE

Company plans to acquire European businesses with an enterprise value in the range of $1-5bn

CVC, Advent, FSI to buy Serie A in €1.7bn deal

Consortium will acquire a 10% stake in a new media company, which will manage Serie A's broadcasting rights

Multiples Heatmap: average entry multiple hits 10.5x as dealflow recovers

The UK and Ireland was the hottest region for multiples in Q3, also seeing the largest increase in valuations of any region

Carlyle to explore sale options for Hunkemöller – report

GP had explored IPO options for the Netherlands-headquartered lingerie and loungewear chain in 2018

German banks and debt funds split LBO market share in Q3 – survey

GCA's Q3 2020 Mid-Cap Monitor also shows that new financing deals increased in the German market

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

Preparing for the turnarounds wave

The much-anticipated wave of distressed opportunities has failed to materialise so far, but market participants are still readying for an uptick

Digital doctors here to stay as telemedicine deals surge

Rise in demand for telemedicine т and promising returns for investors that have been targeting the space т looks set to continue

German PE assesses opportunities in crisis

Panellists from PE and advisory firms discussed the role of private equity in the current deals landscape at Mergermarket's Germany Forum

Unquote Private Equity Podcast: Partnering for portfolio management

Oliver Jones and David Wardrop discuss the potential for new investment opportunities in a post Covid-19 environment

Allocate 2020: CIO views on the road ahead

Catch up on a panel featuring leading international CIOs discussing their portfolio strategies for the coming five years

Genui-backed Fashionette sets IPO price range

Genui bought a 75% stake in the online luxury fashion platform in 2015, investing via its debut fund

Video: Alantra's Andy Currie on the outlook for PE

Unquote interviews Andy Currie from Alantra, winner in the Corporate Finance Firm Of The Year category for the 2020 British Private Equity Awards

CVC, Advent, FSI win exclusivity for Serie A

Consortium plans to acquire a 10% stake in a new media company, which will manage Serie A's broadcasting rights

Italian PE players highlight silver linings amid crisis

Fundraising challenges, portfolio support and new opportunities were key themes discussed at last week’s Unquote Italian Private Equity Forum

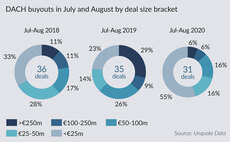

DACH buyout deal value sees sharp summer decline

Following a quiet period for upper-mid-cap dealflow, Unquote gauges market sentiment as to whether activity could pick up before year-end

Parcom in talks to acquire Equistone's Group of Butchers – report

Mergermarket reported that the original sale process fell through as the pandemic took hold

PE firms more bullish than corporates on distressed M&A – survey

Of the PE firms surveyed, t4% cite distressed/turnaround opportunities as a major motivation for acquisitions

Unquote Private Equity Podcast: Allocate 2020 special

The Pod discusses our upcoming LP/GP conference, Allocate, touching on illiquidity solutions, secondaries, and ESG

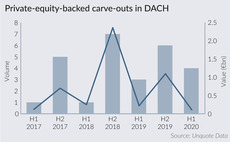

PE players await DACH carve-outs uptick

With corporates under pressure due to the coronavirus pandemic, opportunities are likely to open up for sponsors interested in carve-outs

KKR's Hensoldt sets IPO share price at €12-16

KKR acquired the sensor producer in 2016 and the IPO is set to value the company at up to €2.61bn

PE-backed Allegro announces intention to float

Poland-based e-commerce platform backed by Cinven, Permira and Mid Europa reportedly aims for €10-12bn valuation