Investments

Crosslantic's Hakle to be bought by management – report

Crosslantic Capital invested in the business alongside managing director Volker Jung in 2019

Advent to commit CHF 415m in Dufry rights offering

If approved, the offering would see the GP acquire a minority stake in its former portfolio company

GP Profile: ArchiMed

Following the close of its new €1bn fund, ArchiMed's Denis Ribon discusses the firm's fundraising experience and investment pipeline

Regent-backed Escada files for insolvency

Luxury fashion brand had previously filed for insolvency in 2009 and was bought by Regent in 2019

Unquote Private Equity Podcast: H2 Preview

The Unquote Podcast gathers the whole team this week to go over H1 statistics, look at early recovery signs and share insights from across Europe

Multiples Heatmap: pricing ticks up as GPs flock to safe assets

Although dealflow was severely impacted by Covid-19 in Q2, average entry multiples actually went up given the scarcity of attractive opportunities

Apax, Fortress, Three Hills to bid for Serie A - report

Bidders join other PE firms that have shown interest in Serie A, including CVC, Bain and Advent

Private Equity Pitch: Funds exposed to UK consumer services providers

Unquote and Mergermarket look at individual funds' exposure to UK businesses in the consumer services space

DACH holds up under pandemic pressure, but recovery doubts remain

Market players suggest it is unlikely that H1 figures reflect the extent of the damage done to portfolios and M&A

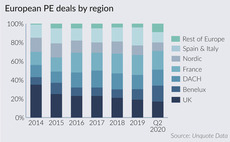

Q2 Barometer: Coronavirus ravages European M&A market

After the first effects of the Covid-19 crisis were felt in March, the European private equity market decelerated sharply in Q2

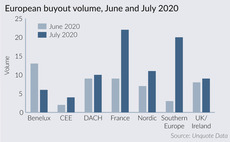

Southern Europe bounces back amid pandemic uncertainty

Southern European market has regained vigour and confidence in July following a catastrophic H1

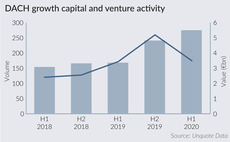

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Venture, tech keep UK market afloat in H1

Buyout and exit volume dropped dramatically in the first half of 2020, while GPs are doubling down on technology-driven strategies

Unquote Private Equity Podcast: Made in Germany

This week, the Unquote Podcast focuses on Germany, where private equity activity has remained resilient despite Covid-19

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

Finland's VC industry remains buoyant despite pandemic

Dealflow in the Finnish VC market remained strong in the peak months of the coronavirus outbreak, with local players cautiously optimistic

DACH buyout market weathers Covid-19 impact, UK and France suffer

Germany emerged as the busiest region in Europe in Q2, albeit with a low volume and aggregate value of deals by historical standards

Fashion victims: GPs face a tough year in the clothing & accessories sector

Unquote explores dealflow expectations and potential silver linings for the segment, which has been one of the hardest hit by the pandemic

Battery Ventures issues public takeover offer for Easy Software

Offer has been accepted by majority shareholders Global Derivative Trading and Deutsche Balaton

2011-vintage funds: what is still in Nordic portfolios

Unquote and Mergermarket round up a selection of assets still held in 2011-vintage funds managed by Nordic GPs

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

Aurelius's Zim Flugsitz in self administration

Aurelius intends to make contributions to the airline seat producer's proposed restructuring

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

Mercia invested £17.5m in 2019/20

Mercia's NVM VCTs raised ТЃ38.2m in new capital, while the BBB also allocated an additional ТЃ54.3m