Investments

3i invests in US-based WilsonHCG

Equity investment of $120m follows previous backing from Frontier Capital and CIP Capital

Tikehau launches SPAC to invest in financial services sector

Tikehau sponsors the vehicle in partnership with FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi

Latour to acquire 33% stake in Charterhouse's Funecap – report

GP reportedly placed the funeral service provider up for sale in 2020, advised by DC Advisory

Video: Healthcare Sector Focus virtual event

Expert speakers discuss the short-term impacts of Covid-19, as well as the longer-term effect on traditional healthcare infrastructure

Prime Fund aiming to close 10 new investments this year

Newly launched Czech technology fund is open-ended and aims to raise CZK 1bn in total

VC-backed Auto1 announces IPO pricing

IPO of the used-car trading platform is expected on the Frankfurt Stock Exchange on 4 February 2021

TEP Capital to build portfolio of six Polish investments

Poland-based TEP Capital was set up a year ago and is funded by German conglomerate Thomas Gruppe

Unquote Private Equity Podcast: Venture's immunity

Simon Philips, CEO of ScaleUp Capital, joins the Unquote podcast to explore recent trends in the European venture space

Sequoia Capital to invest in Auto1 prior to IPO – report

IPO of used car trading website could generate proceeds of €1bn, the company said in a statement

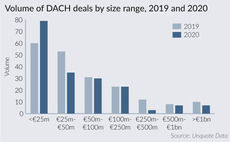

DACH small-cap deals weather the storm

Small-cap dealflow remained fairly stable in the DACH region in 2020, despite the coronavirus crisis

DACH venture and growth deals peak in crisis

Following a strong year in volume terms, market participants remain optimistic about the resilience of the venture ecosystem

VC-backed Pflege.de to be acquired by Hartmann

VCs who have backed the home care information website include Hanse Ventures and Holtzbrinck Digital

Covid-19 impact expected to be more severe than GFC – survey

Almost all Dechert survey respondents expect distressed deals to increase, while 82% cited more deal delays as an ongoing effect

Unquote Private Equity Podcast: Nordic 2020 Review

Katharine Hidalgo welcomes Unquote Nordic reporter Eliza Punshi to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

2021 Preview: Dry powder drives DACH prospects for 2021

DACH players adopted increased portfolio management and defensive investment decisions in 2020, but dry powder is set to drive 2021

Unquote Private Equity Podcast: DACH 2020 Review

Katharine Hidalgo welcomes Unquote DACH reporter Harriet Matthews to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

Unquote Private Equity Podcast: France 2020 review

Katharine Hidalgo welcomes Unquote editor Greg Gille to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

Unquote Private Equity Podcast: UK & Ireland 2020 Review

Early figures highlight how a 2008-style meltdown was averted in 2020, both in terms of deal-doing and fundraising

2021 Preview: Southern Europe looks for 2021 rebound

Covid-19 hit both dealflow and fundraising across the region – but local players are still looking forward to a gradual recovery in 2021

Unquote Private Equity Podcast: Southern Europe 2020 Review

National coronavirus restrictions threatened to scupper the PE industry across Europe in the spring, but investors adapted swiftly

A year to remember - and learn from

Unquote recaps a year like no other, and maps out what market players expect when it comes to dealmaking and fundraising from 2021

Download the December 2020 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

2021 Preview: Nordic region weathers brunt of pandemic

Nordic countries lived up to their reputation as PE stronghold in 2020, with strong H2 recovery and record VC investments in the region

Q3 Barometer: Green shoots emerge

Aggregate value of deals was noticeably up in Q3 as the reopening of debt markets boosted transaction sizes