Investments

Real Madrid seeks legal action against LaLiga/CVC deal

Board agrees to initiate both civil and criminal legal action against La Liga's president, CVC's managing partner and CVC itself

Video: Q&A with Rutland Partners' David Wardrop

David Wardrop joins Unquote editor Greg Gille to discuss how the firm is approaching the post-Covid investment landscape

Podcast: In conversation with… Kerry Baldwin, IQ Capital & BVCA

New BVCA chair discusses her priorities for the year ahead, the buoyant environment for venture, how to improve PE's public image, and more

Capiton raises top-up single asset fund for KD Pharma

GP completed its first single-asset deal for KD Pharma in 2019, having acquired the company in 2013

Unquote Private Equity Podcast: H1 review special

The team looks at key takeaways and numbers across deal-doing and fundraising, and ponders where the market might be headed

French buyout market continues strong rebound in H1

France was home to nine €1bn+ buyouts, comfortably outpacing the UK and German markets

European PE buyout activity sets new record in H1

Hectic first quarter drove an unprecedented spike in deal activity, while aggregate value is just shy of hitting an all-time high

Multiples continue to climb in Nordic region as activity booms

Nordic PE market saw record levels of deal value in Q1, with valuations soaring even higher on the back of renewed optimism

Healthcare valuations heat up as high-profile assets crystallise competition

Healthcare sector saw multiple valuations pick up in Q1 2021 and hit a record high of 13.7x

PE deal-making surge of 2021 could break one more record

Recent trends in the mega-deal segment indicate that the Alliance Boots buyout of 2007 is a record that is close to being broken

Unquote Private Equity Podcast: Pandemic premiums

Following the publication of the Q1 2021 Multiples Heatmap, Unquote welcomes Clearwater's executive team to discuss pricing trends

CGT rate hike to curb HNWI investment appetite - survey

One in four private investors would reduce their investments into SMEs by 50% or more, says Connection Capital

Pandemic success boosts appeal of "misunderstood" gaming sector

PE and VC interest for the sector has picked up in the past few years after a lull, and the pandemic could turn some of these bets into winners

Multiples Heatmap: hectic Q1 further fuels valuation hike

Deal multiples saw four consecutive quarterly increases to reach 11.5x in the first quarter of 2021

Oaktree provides €275m in financing to Inter Milan

Following the deal, Suning and LionRock pledge their stakes in the company as collateral

Q1 Barometer: Total European deal value reaches new decade high

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

EQT's Suse sets share price for €5bn IPO

Listing of the open-source enterprise software business is expected on 19 May 2021

Q1 DACH VC and growth deals surpass previous volume high

Deal volume has grown steadily since Q2 2019; aggregate value has also been rising since Q2 2020

Hg-backed MeinAuto postpones IPO

Car sales platform cited "currently adverse conditions for high-growth companies" in a statement

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Appetite for DACH tech deals continues apace in Q1

Sponsor demand for differentiated IT services and roll-up strategies remains consistent

EQT's Suse sets out IPO plans

Enterprise software platform intends to generate net proceeds of $500m with its Q2 2021 IPO

Inflexion and Informa combine FBX, Novantas

Inflexion and Novantas will each own a minority stake in the newly formed financial data business

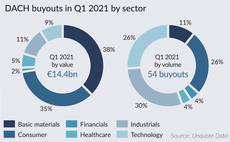

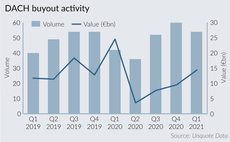

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic