Investments

Paragon-backed Apontis Pharma announces IPO intention

Paragon acquired the pharmaceutical business from its parent company UCB in 2018 via Paragon II

Hg's MeinAuto announces intention to float

Hg invested in the new car sales platform in 2018; prior backers included HV Capital and DN Capital

PE-backed diagnostics firm Synlab announces IPO pricing

Shares will be priced at €18-23, equating to a €4-5bn market capitalisation and €5.9-6.9bn EV

Buyout rankings: who invested the most in Europe in Q1 2021?

Unquote tallies the top 10 most active GPs across the European buyout space in the first quarter

PE players seek opportunities in minority deals, differentiated strategies

Minority investments, co-investments and other creative deals made via differentiated strategies could become even more relevant post-pandemic

Q&A: Debevoise's Bet-Mansour and Scoville on Spacs' relevance for PE

The partners share their thoughts on why Spacs are so attractive, what sponsors should be wary of, and whether they expect a similar uptake in Europe

3i's Carnimolla and Howard on investing in naturality businesses

With a significant increase in the number of people focusing on their physical and mental wellbeing, 3i sees growing opportunities for PE

Register for the Growth Equity virtual event

Leading industry participants will discuss the outlook for growth equity on Thursday 22 April

PE-backed Synlab announces IPO intention

Cinven, Novo Holdings and OTTP hold stakes in the Germany-based laboratory diagnostics group

Unquote Private Equity Podcast: Ravenous for recurring revenue

The Unquote Private Equity Podcast is back to its regular format this week, with the team looking at PE's appetite for recurring revenue models

Q4 Barometer: How European activity returned to pre-pandemic level

European PE deal value staged an impressive recovery over the course of 2020, capped by a busy Q4

Back to school: education dealflow heats up as pandemic settles

Digital opportunities and long-term growth drivers have resulted in an influx of deals in recent weeks, with more in the pipeline

ICG invests in $80m round for Eliem Therapeutics

This is the first investment made by ICG Life Sciences, which was launched in January 2021

Podcast: In conversation with... Jan Kengelbach, BC Partners

Portfolio operations partner Kengelbach shares his experience and lessons learned from getting hands-on with portfolio company Aenova

Unquote Private Equity Podcast: the price is right?

Following the publication of the Q4 2020 Multiples Heatmap, Unquote welcomes Clearwater's executive team to discuss pricing trends

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Quantifying PE's appetite for recurring revenue models

Buyouts in sectors where recurring revenue models are predominant went from 8% of European volume in 2010 to 22% in 2021 to date

Sharp focus on top assets boosts average multiple in consumer sector

Covid-resilient assets are the only ones coming to market, with suitably hefty price tags, says Clearwater's O'Donnell

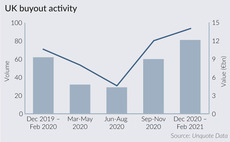

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods

Nordic players await distressed carve-out uptick

Carve-out activity in the Nordic region hit a three-year low last year, but was still propped up mainly by corporates divesting healthy assets

Biotech market provides dose of optimism

In the past year, the biotech market has seen buoyant activity, reaching record levels of investments

No need to panic about high dry powder as PE market comes roaring back, says Bain

Appetite remains high for deal-making and exits, according to Bain & Companyтs 2021 Global Private Equity Report

France: strong deals pipeline fuels high average entry multiple

Sponsors fight tooth and nail for prized assets in defensive sectors such as healthcare, higher education and financial services

Multiples Heatmap: average pricing hits 11x in busy Q4

Healthcare, financial services and TMT assets continue to drive valuations up, while Nordic and UK regions see highest multiples