Industry

Berlin: A venture giant in the making

Berlin's venture scene has come a long way in recent years and is now developing into a mature ecosystem

Spanish fundraising down by 25% in 2015, says Ascri

unquote" revisits eight key fund-related developments within Spanish private equity in 2015

Electra to review strategy following Bramson appointment

Review will take place before Q4 this year, with Electra stressing the success of its current strategy

Value of European buyouts rose by almost 35% in 2015

Leading with an impressive hike in aggregate value, discover the key findings of our Annual Buyout Review

Bryan Garnier & Co merges with Cartagena Capital

Put together, the two firms have been involved in more than 60 transactions in the part 24 months

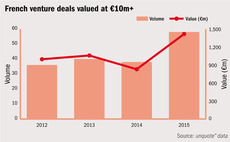

Competition, maturity drive swell in French VC investments

Paris's venture scene is thriving, with increasingly larger investments being deployed

CapMan's fund advisory business rebrands to Scala

Scala Fund Advisory will continue to provide fundraising, secondaries services to European investors

Still no turnaround fund in sight for Nordic market

Could 2016 see the arrival of Nordic turnaround funds given continued LP demand for the strategy?

Clessidra appoints new CEO and chair after death of founder Sposito

Claudio Sposito, founder and CEO of the Italian GP, passed away after a short illness aged 60

Constellation Capital rebrands to Ufenau

GP renamed in order to have a more unique name and highlight Swiss roots

UK PE firms struggle to find new recruits amid thriving market

As the UK PE market enjoys more buoyant conditions, sourcing new team members is proving tough

Dutch MPs unveil green paper against private equity

Dutch Labour MP Henk Nijboer has published his proposals on how to reform the private equity market

Catterton, LVMH, Arnault merge PE operations to create L Catterton

New player to target global consumer space as it grows portfolio beyond $12bn

Coller collects $7.15bn for seventh fund

CIP VII was oversubscribed and raised in around six months

DBAG secures €50m debt facility

The GP has more than €1.2bn in assets under management and made eight investments last year

Boomerang buyouts: returning to old assets

A string of recent deals have seen GPs returning to former assets; is this a safe strategy?

Q&A: Social impact integral to competitive businesses

EIF's Grabenwarter discusses importance of social impact investing

Doughty Hanson CEO Marquardt to step down in January

Resignation comes amid push by GP to resume fundraising after shutdown in April

Graphite to sell listed funds-of-funds manager to ICG for £20m

Move comes as part of GP's plan to focus on direct mid-market buyout business

Comment: Jersey benefiting from EU regulation

Jersey Finance CEO Geoff Cook makes a case for Jersey's attractiveness for PE funds

Comment: Prolific year bodes well for 2016

Mo Merali of Grant Thornton predicts a positive 2016 for private equity

France: Strong policy support needed for prosperous 2016

French PE has had a strong 2015 but stronger policy support is needed

UK clarifies carried interest taxation rule proposals

unquote" runs the numbers to see how changes may impact the industry

Building Baltic bridges vital to region's buy-and-builds

Strategies to build out portfolio companies into neighbouring countries could provide welcome growth